Show the Custom theme

# Custom theme

custom_theme <-

theme(axis.title = element_text(face = "bold"),

plot.title = element_text(face = "bold"),

axis.line = element_line(),

axis.text.x = element_text(angle = 0, face = "bold", size = 7),

axis.text.y = element_text(face = "bold"),

axis.title.x = element_text(face = "bold",size = 10),

axis.title.y = element_text(face = "bold", size = 10),

plot.subtitle = element_text(face = "italic"),

plot.caption = element_text(face = "italic"),

panel.grid.minor.x = element_blank(),

panel.grid.minor.y = element_blank(),

panel.grid.major.x = element_blank(),

panel.grid.major.y = element_line(

color = "black", linetype = "dashed", linewidth = 0.05),

panel.border = element_blank(),

strip.background = element_blank(),

panel.background = element_blank(),

strip.text = element_text(angle = 0, face = "bold", size = 7),

legend.title = element_text(face = "bold", size = 11),

legend.text = element_text(face = "italic", size = 10),

legend.box.background = element_rect(),

legend.position = "top") 1 Disclaimer

This work examine the paper Peterson (2018) and tries to reproduce its results considering the Bitcoin price from 2017-04-08 up to 2023-05-23.

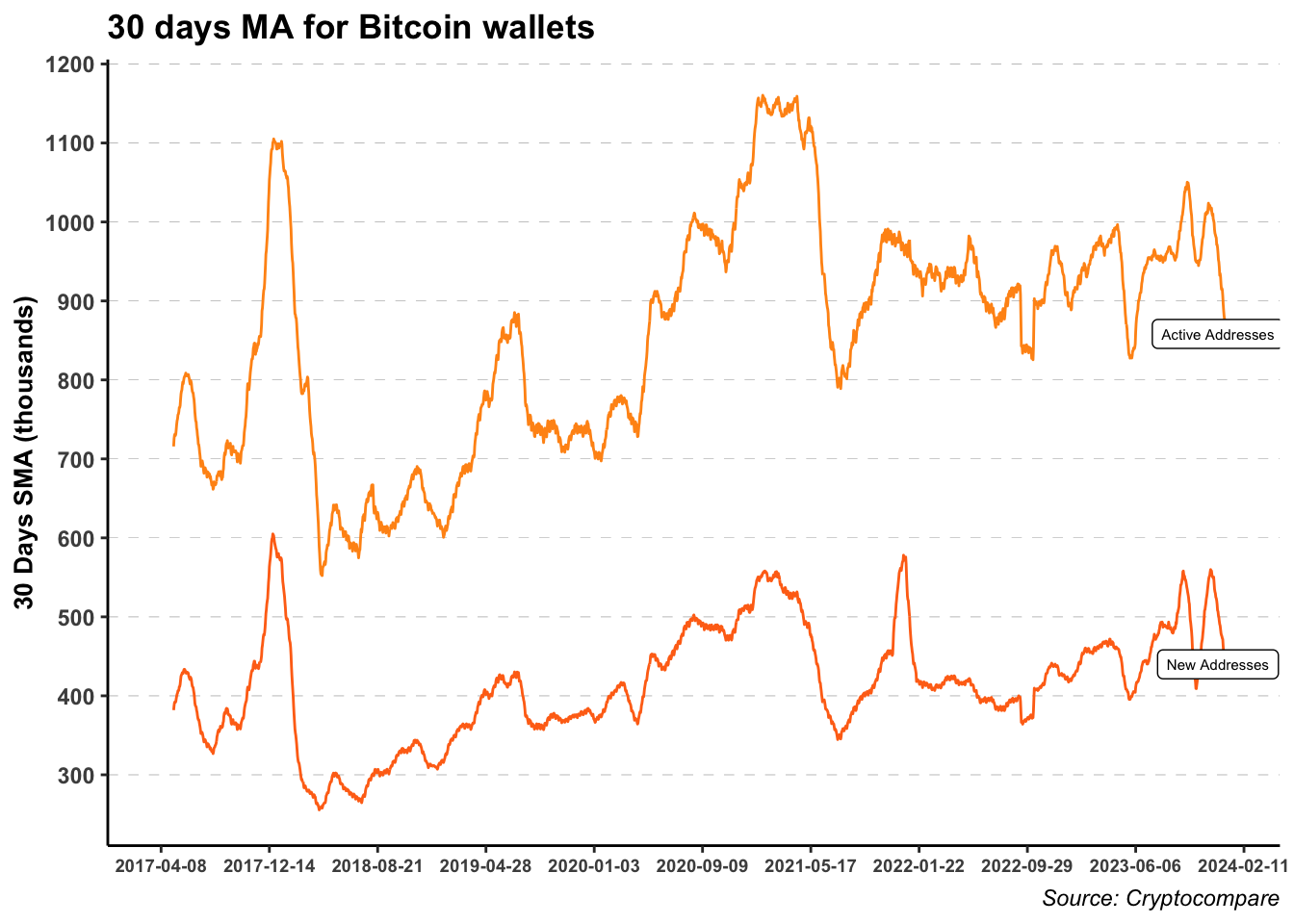

2 On-chain analysis

Show the code

BTC_chain$SMA_active_addresses <- SMA(BTC_chain$active_addresses, n = 30)

BTC_chain$SMA_new_addresses <- SMA(BTC_chain$new_addresses, n = 30)

ggplot()+

geom_line(data = BTC_chain, color = "#FF9416",

aes(Date, SMA_active_addresses/1000)) +

geom_line(data = BTC_chain, color = "#FF7116",

aes(Date, SMA_new_addresses/1000)) +

geom_label(data = tail(BTC_chain, 1), color = "black", size = 2,

aes(Date-20, SMA_new_addresses/1000, label = "New Addresses")) +

geom_label(data = tail(BTC_chain, 1), color = "black", size = 2,

aes(Date-20, SMA_active_addresses/1000, label = "Active Addresses")) +

labs(title = "30 days MA for Bitcoin wallets", caption = "Source: Cryptocompare",

x = NULL, y = "30 Days SMA (thousands)") +

custom_theme +

scale_x_date(breaks = seq.Date(as.Date("2017-04-08"), Sys.Date(), 250)) +

scale_y_continuous(breaks = seq(0, 2000, 100))

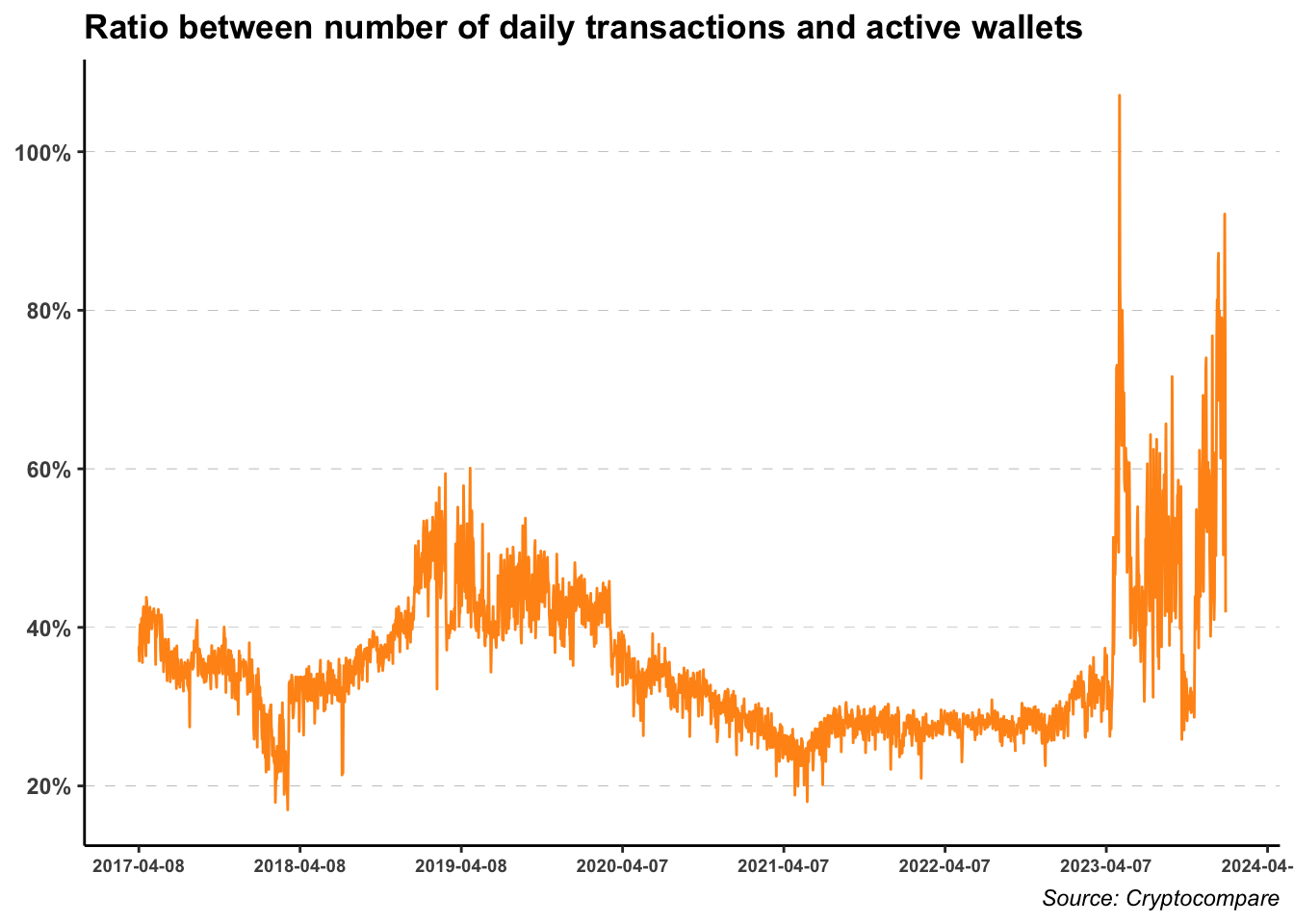

Show the code

ggplot(BTC_chain)+

geom_line(aes(Date, transaction_count/active_addresses*100), color = "#FF9416" )+

custom_theme +

labs(title = "Ratio between number of daily transactions and active wallets",

caption = "Source: Cryptocompare", x = NULL, y = NULL) +

scale_x_date(breaks = seq.Date(as.Date("2017-04-08"), Sys.Date(), 365))+

scale_y_continuous(breaks = seq(0, 400, 20), labels = paste0(seq(0, 400, 20), "%"))

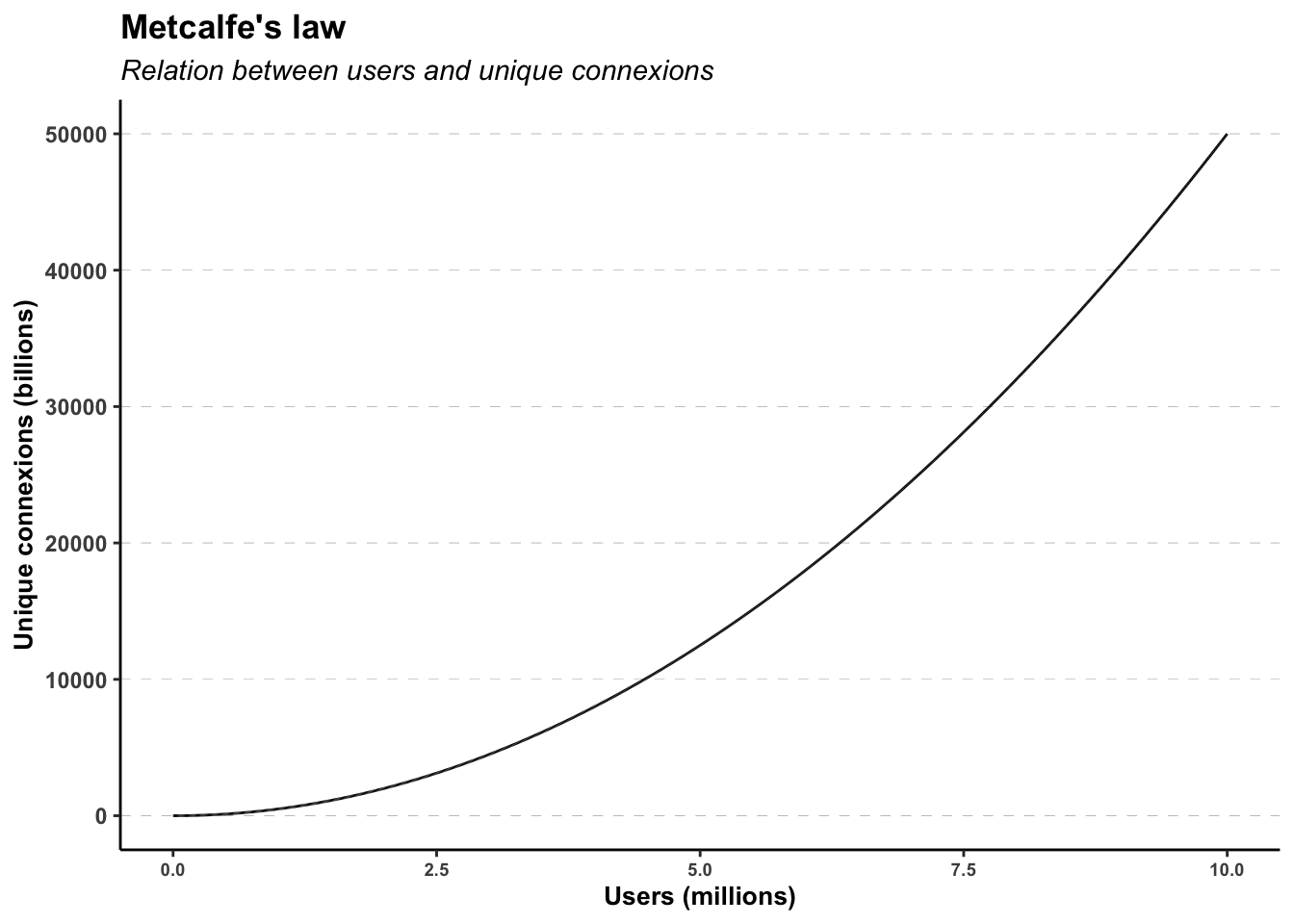

3 Metcalfe law

Metcalfe’s Law applied to Bitcoin states that the value of a network is proportional to the square of its user base. In the context of Bitcoin, this means that as more people join and use the cryptocurrency, its overall value increases exponentially. Bitcoin operates on a decentralized peer-to-peer network, allowing users to send and receive payments without intermediaries. The reasoning behind the use of this model is that the more participants in the Bitcoin network, the greater should be the potential for transactions and the network’s utility.

The law is named for Robert Metcalfe and first proposed in 1980, albeit not in terms of users, but rather of “compatible communicating devices”, such as telephones. It later became associated with users on the Ethernet.

Metcalfe’s Law is related to the fact that the number of unique possible connections \(C_n\) in a network of \(n\) nodes. It can be expressed mathematically as a number asymptotically proportional to \(n^2\).

\[C_n = \frac{n(n-1)}{2} \underset{n \to \infty}{\propto} n^2\]

Show the code

Metcalfe himself, however, applied a proportionality factor \(A\) that he acknowledged could decrease over time. The law was originally designed to identify the number of users \(n\) at which the costs \(C\) for network implementation would be recovered (originally applied to telephone networks). In mathematical terms:

\[M(n) = nC = A \frac{n(n-1)}{2}\]

4 Reed’s Law Network Model

Reed’s law is the assertion that the utility of large networks, particularly social networks, can scale exponentially with the size of the network. The reason for this is that the number of possible sub-groups of network participants is:

\[C_n = 2^n - n - 1 \] This grows much more rapidly than either the number of users \(n\), or the number of possible pair connections \(n^2\).

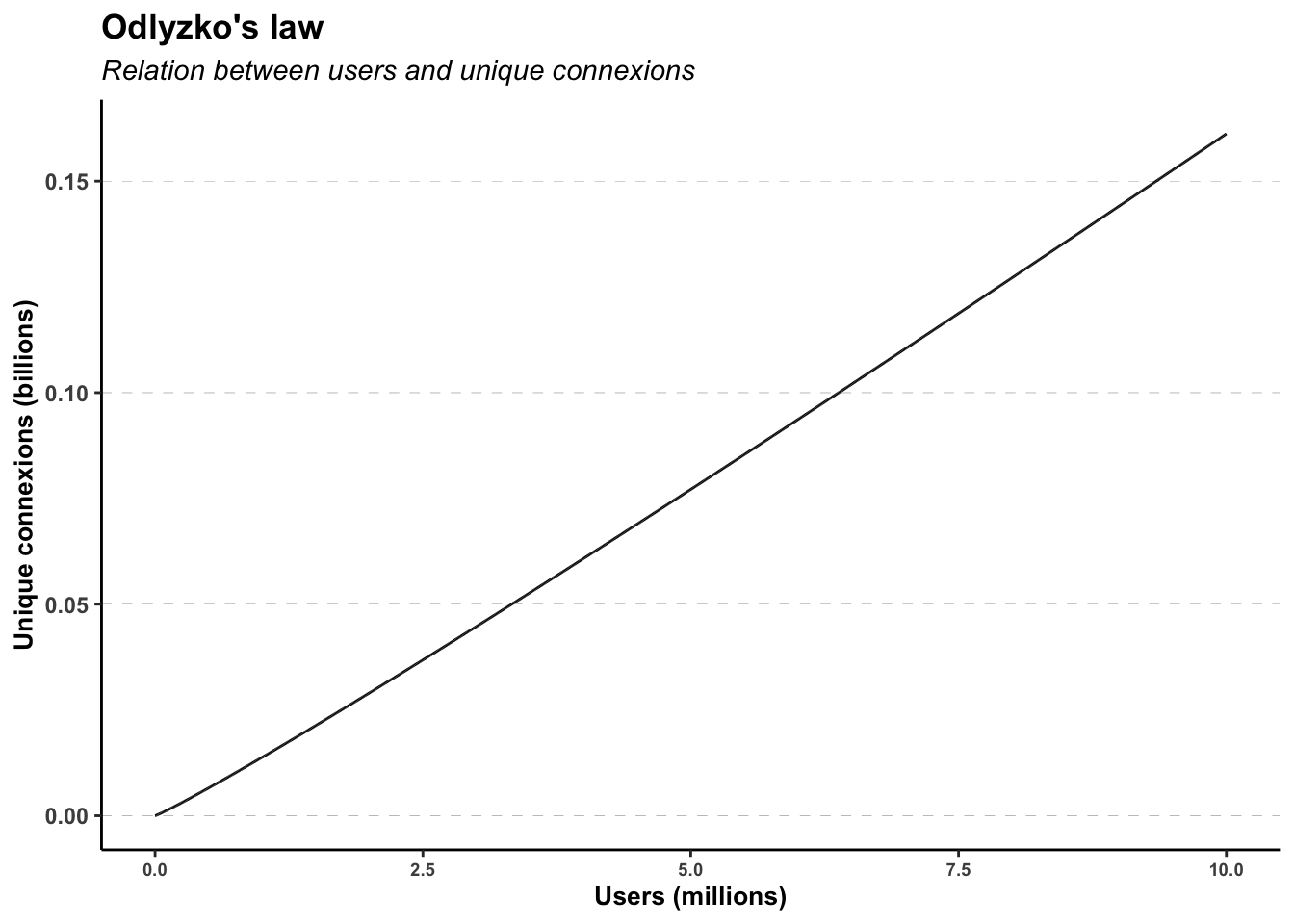

5 Odlyzko’s Law Network Model

Briscoe et. al. [2006] believe that Metcalfe’s and Reed’s laws are too optimistic in their values. They argue, without mathematical proof, the growth rate of the network must decrease as subsequent members join because the most valuable links are likely to be formed first. This parallels the concept of “diminishing returns” central to neo classical economics. Such diminishing incremental value was modeled:

\[n \, \, \text{log}(n) \]

Show the code

6 Bitcoin inflation

Code

df_bitcoin_supply <- BitcoinSupply(end_date = "2045-01-01", quiet = TRUE)

df_bitcoin_halving <- df_bitcoin_supply[df_bitcoin_supply$Halving,]

y_breaks <- seq.int(min(df_bitcoin_supply$Supply), max(df_bitcoin_supply$Supply), by = 2000000)

ggplot()+

geom_line(data = df_bitcoin_supply, aes(Date, Supply)) +

geom_point(data = df_bitcoin_halving, aes(Date, Supply), color = "red") +

geom_segment(data = df_bitcoin_halving, color = "red", linetype = "dashed",

aes(x = Date, xend = Date, y = 0, yend = Inf)) +

geom_label(data = df_bitcoin_halving, color = "red", linetype = "dashed", size = 3,

aes(x = Date, y = 0, label = paste0("Halving ", N_Halving))) +

scale_y_continuous(breaks = y_breaks, labels = as.character(y_breaks)) +

custom_theme +

labs(x = "Time (days)", y = "Total supply (BTC)", title = "Bitcoin monetary supply")7 Bitcoin Equilibrium Price with Network Models

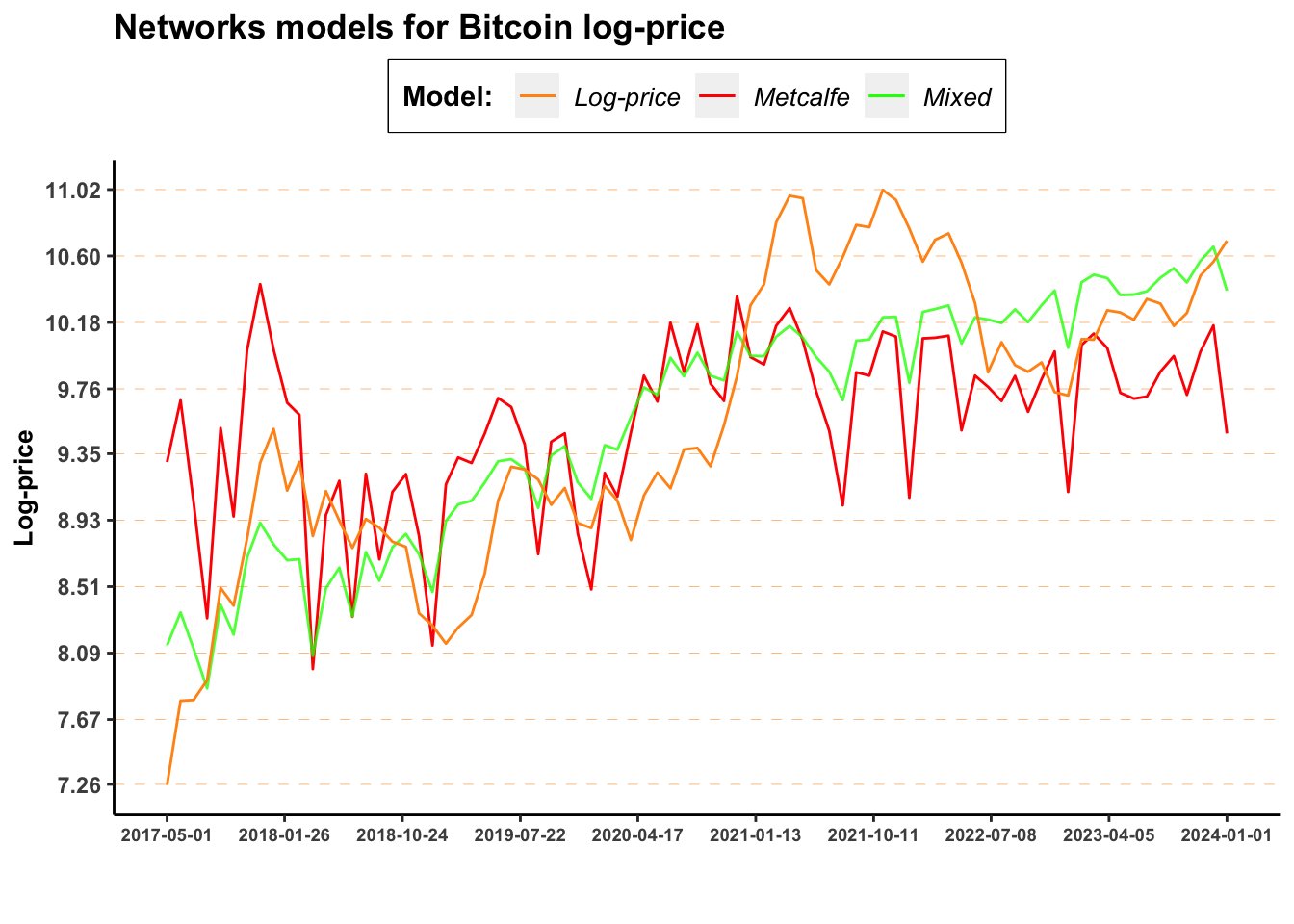

Code

BTC <- left_join(select(BTC_daily, Date, Symbol, Price = "Close"),

select(BTC_chain,

Date, active_addresses, transaction_count, current_supply, hashrate),

by = "Date")

index_date <- seq.Date(as.Date("2017-01-01"), as.Date("2024-01-01"), by = "1 month")

BTC <- filter(BTC, Date %in% index_date)

BTC$log_price <- log(BTC$Price)

# Network Value

BTC$metcalfe <- BTC$active_addresses*(BTC$active_addresses-1)/2

BTC$value_metcalfe <- log(BTC$metcalfe*(1/BTC$current_supply))

BTC$odlyzko <- BTC$active_addresses*log(BTC$active_addresses)

BTC$value_odlyzko <- log(BTC$odlyzko*(1/BTC$current_supply))

BTC <- na.omit(BTC)

metcalfe_model_BTC <- lm(log_price ~ value_metcalfe, data = BTC)

odlyzko_model_BTC <- lm(log_price ~ value_odlyzko , data = BTC)

mixed_model_BTC <- lm(log_price ~ value_metcalfe + value_odlyzko, data = BTC)

BTC %>%

mutate(fitted_metcalfe = predict(metcalfe_model_BTC),

fitted_odlyzko = predict(odlyzko_model_BTC),

fitted_mixed = predict(mixed_model_BTC)) %>%

ggplot() +

geom_line(aes(Date, fitted_metcalfe, color = "metcalfe"))+

geom_line(aes(Date, fitted_mixed, color = "mixed"), alpha = 0.8)+

#geom_line(aes(Date, fitted_odlyzko, color = "odlyzko"), alpha = 0.8)+

geom_line(aes(Date, log_price, color = "log_price"))+

scale_color_manual(values = c(metcalfe = "red", odlyzko = "purple",

mixed = "green", log_price = "#FF9416"),

labels = c(metcalfe = "Metcalfe", odlyzko = "Odlyzko",

mixed = "Mixed", log_price = "Log-price" ))+

scale_y_continuous(breaks = round(seq(min(BTC$log_price), max(BTC$log_price), length.out=10),2))+

scale_x_date(breaks = seq.Date(min(BTC$Date), max(BTC$Date), length.out = 10))+

theme(axis.title = element_text(face = "bold"),

plot.title = element_text(face = "bold"),

axis.line = element_line(),

axis.text.x = element_text(angle = 0, face = "bold", size = 7),

axis.text.y = element_text(face = "bold"),

axis.title.x = element_text(face = "bold",size = 10),

axis.title.y = element_text(face = "bold", size = 10),

plot.subtitle = element_text(face = "italic"),

plot.caption = element_text(face = "italic"),

panel.grid.minor.x = element_blank(),

panel.grid.minor.y = element_blank(),

panel.grid.major.x = element_blank(),

panel.grid.major.y = element_line(color = "#FF9416", linetype = "dashed", linewidth = 0.1),

panel.border = element_blank(),

strip.background = element_blank(),

panel.background = element_blank(),

strip.text = element_text(angle = 0, face = "bold", size = 7),

legend.title = element_text(face = "bold", size = 11),

legend.text = element_text(face = "italic", size = 10),

legend.box.background = element_rect(),

legend.position = "top") +

labs(color="Model: ")+

ggtitle("Networks models for Bitcoin log-price") +

labs(x ="", y="Log-price", caption = "")

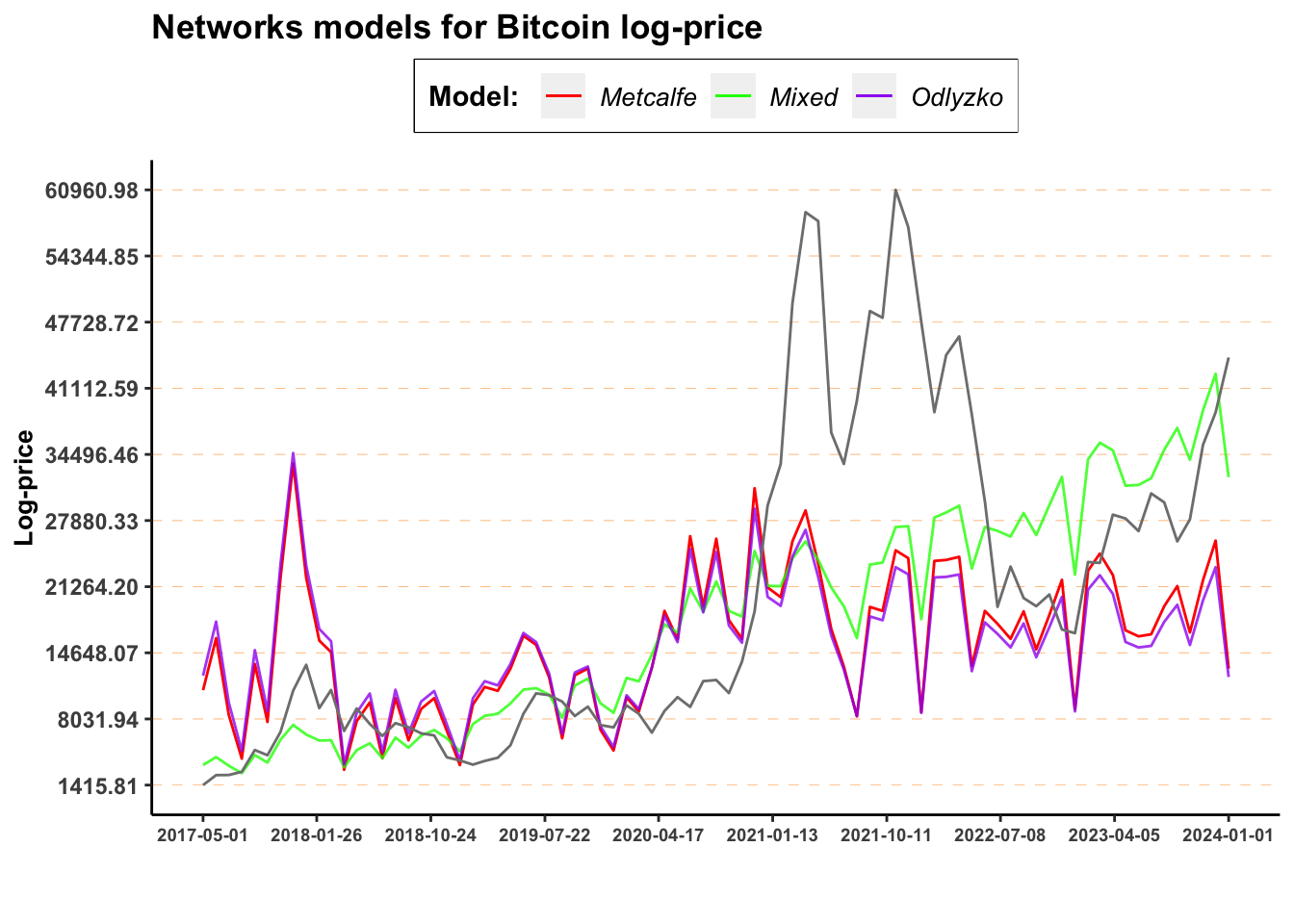

Code

BTC %>%

mutate(fitted_metcalfe = predict(metcalfe_model_BTC) %>% exp(),

fitted_odlyzko = predict(odlyzko_model_BTC)%>% exp(),

fitted_mixed = predict(mixed_model_BTC)%>% exp()) %>%

ggplot() +

geom_line(aes(Date, fitted_metcalfe, color = "metcalfe"))+

geom_line(aes(Date, fitted_mixed, color = "mixed"), alpha = 0.8)+

geom_line(aes(Date, fitted_odlyzko, color = "odlyzko"), alpha = 0.8)+

geom_line(aes(Date, log_price%>% exp(), color = "price"))+

scale_color_manual(values = c(metcalfe = "red", odlyzko = "purple", mixed = "green",

log_price = "#FF9416"),

labels = c(metcalfe = "Metcalfe", odlyzko = "Odlyzko", mixed = "Mixed",

price = "Price" ))+

scale_y_continuous(breaks = round(seq(min(exp(BTC$log_price)), max(exp(BTC$log_price)), length.out=10),2))+

scale_x_date(breaks = seq.Date(min(BTC$Date), max(BTC$Date), length.out = 10))+

theme(axis.title = element_text(face = "bold"),

plot.title = element_text(face = "bold"),

axis.line = element_line(),

axis.text.x = element_text(angle = 0, face = "bold", size = 7),

axis.text.y = element_text(face = "bold"),

axis.title.x = element_text(face = "bold",size = 10),

axis.title.y = element_text(face = "bold", size = 10),

plot.subtitle = element_text(face = "italic"),

plot.caption = element_text(face = "italic"),

panel.grid.minor.x = element_blank(),

panel.grid.minor.y = element_blank(),

panel.grid.major.x = element_blank(),

panel.grid.major.y = element_line(color = "#FF9416", linetype = "dashed", linewidth = 0.1),

panel.border = element_blank(),

strip.background = element_blank(),

panel.background = element_blank(),

strip.text = element_text(angle = 0, face = "bold", size = 7),

legend.title = element_text(face = "bold", size = 11),

legend.text = element_text(face = "italic", size = 10),

legend.box.background = element_rect(),

legend.position = "top") +

labs(color="Model: ")+

ggtitle("Networks models for Bitcoin log-price") +

labs(x ="", y="Log-price", caption = "")

Code

| Model | term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|---|

| Metcalfe | (Intercept) | -2.502297 | 1.8897676 | -1.324130 | 0.1892784 |

| Metcalfe | value_metcalfe | 1.221037 | 0.1911761 | 6.386976 | 0.0000000 |

| Odlyzko | (Intercept) | 10.540437 | 0.2006525 | 52.530812 | 0.0000000 |

| Odlyzko | value_odlyzko | 2.133695 | 0.3926249 | 5.434436 | 0.0000006 |

| Mixed | (Intercept) | -142.473848 | 14.1333207 | -10.080706 | 0.0000000 |

| Mixed | value_metcalfe | 14.203414 | 1.3118594 | 10.826934 | 0.0000000 |

| Mixed | value_odlyzko | -25.499556 | 2.5644609 | -9.943437 | 0.0000000 |

Code

| Model | r.squared | adj.r.squared | sigma | statistic | p.value | df | df.residual | nobs |

|---|---|---|---|---|---|---|---|---|

| Metcalfe | 0.3405316 | 0.3321839 | 0.7398415 | 40.79346 | 0e+00 | 1 | 79 | 81 |

| Odlyzko | 0.2721114 | 0.2628977 | 0.7772740 | 29.53310 | 6e-07 | 1 | 79 | 81 |

| Mixed | 0.7091764 | 0.7017194 | 0.4944504 | 95.10191 | 0e+00 | 2 | 78 | 81 |

References

Citation

@online{sartini2024,

author = {Sartini, Beniamino},

title = {Bitcoin and {Metcalfe} {Law}},

date = {2024-06-19},

url = {https://cryptoverser.org/articles/bitcoin-metcalfe/bitcoin-metcalfe.html},

langid = {en}

}