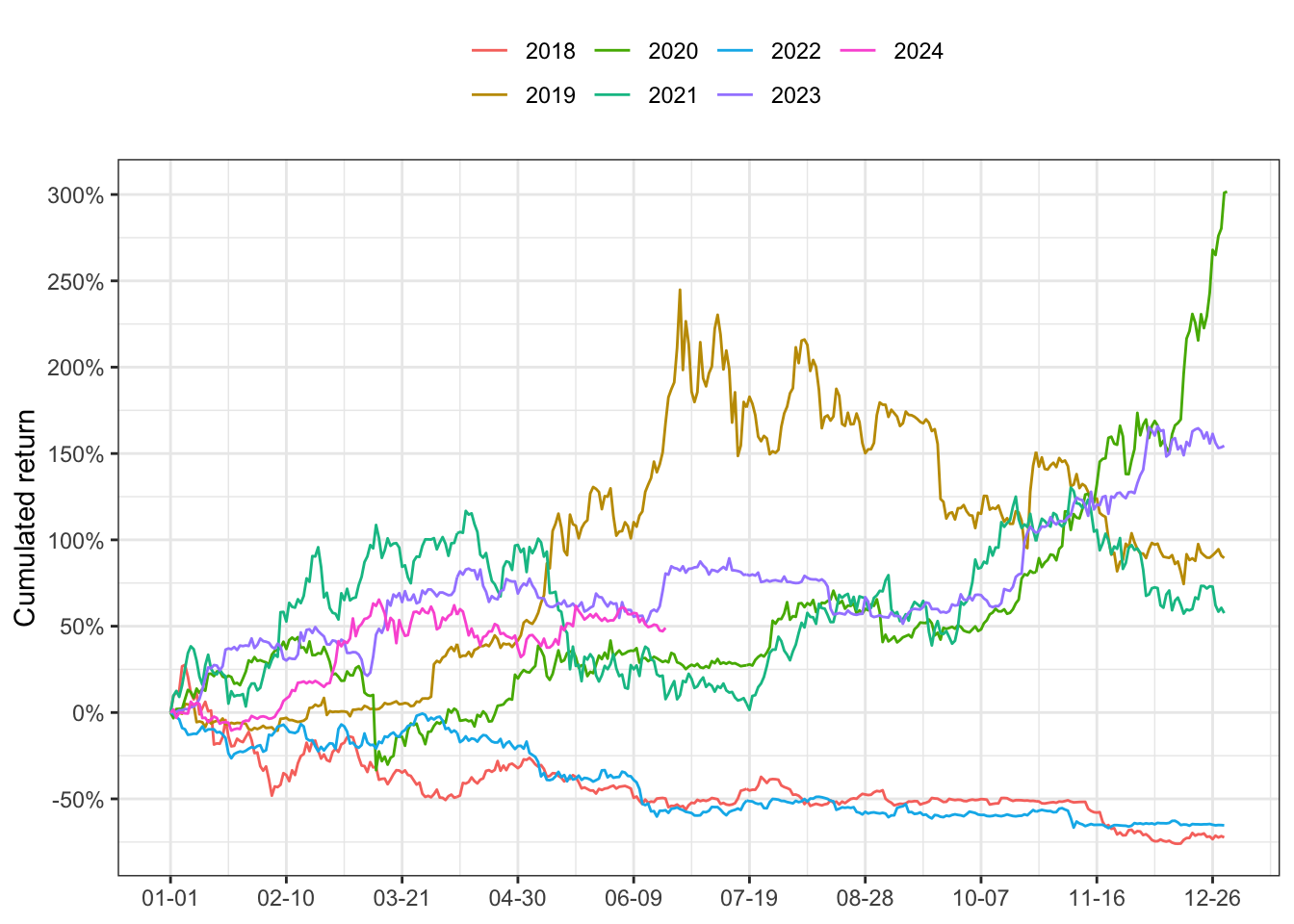

The seasonal effect on Bitcoin (BTC) returns refers to the observed patterns and trends that occur during specific periods within a year. Researchers have found evidence suggesting the presence of seasonality in BTC returns, indicating recurring patterns that investors and traders can potentially exploit. These patterns can help inform investment strategies and improve market timing.

Code

date_to_plot <- max(BTCUSDT$date)

date_from_plot <- date_to_plot - lubridate::days(60)

# Candle chart plot of last 60 days

BTCUSDT %>%

filter(date >= date_from_plot & date <= date_to_plot) %>%

ggplot()+

binancer::geom_candlechart(aes(x = date, close = close, open = open, low = low, high = high))+

theme_bw()+

theme(legend.position = "none")+

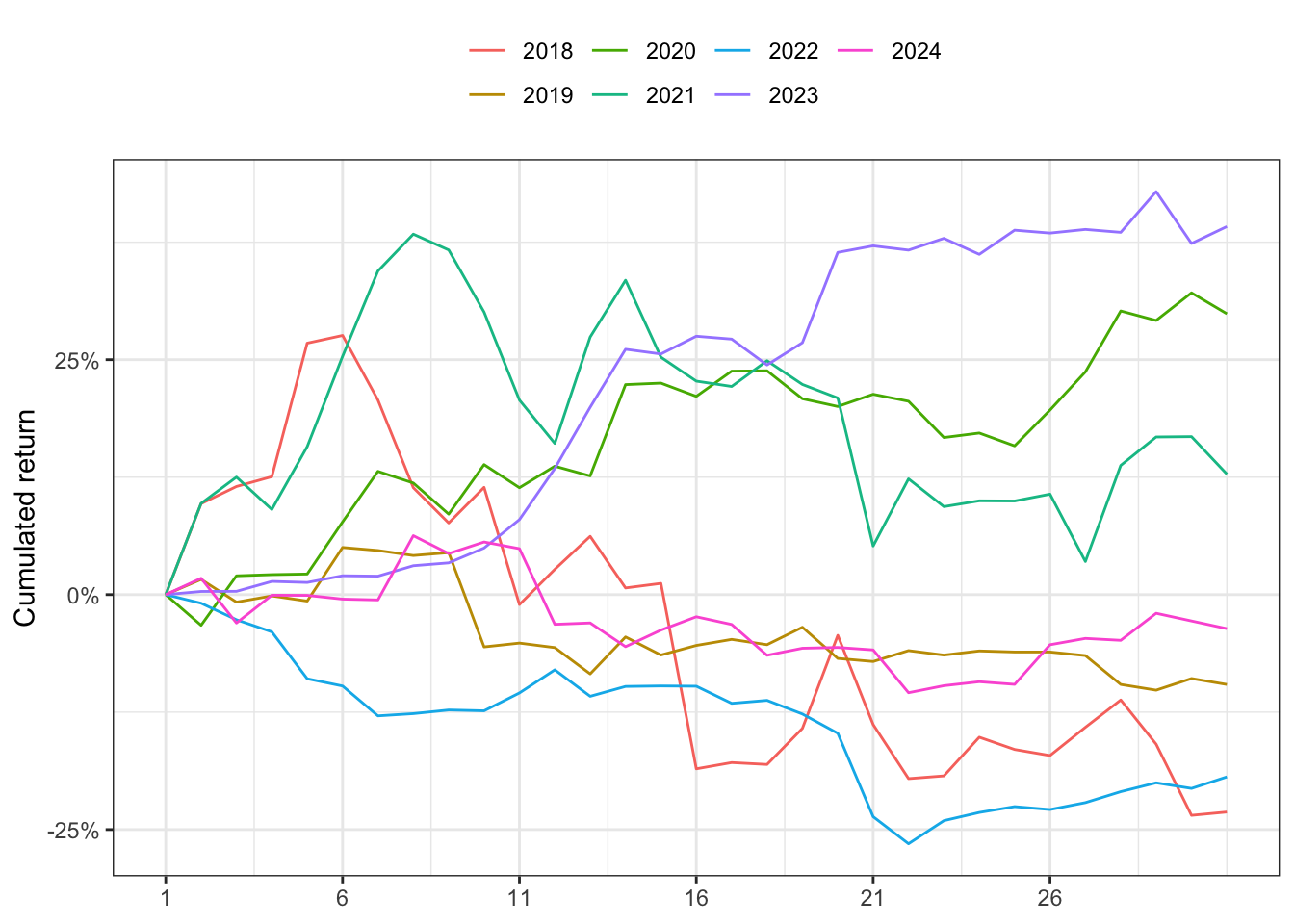

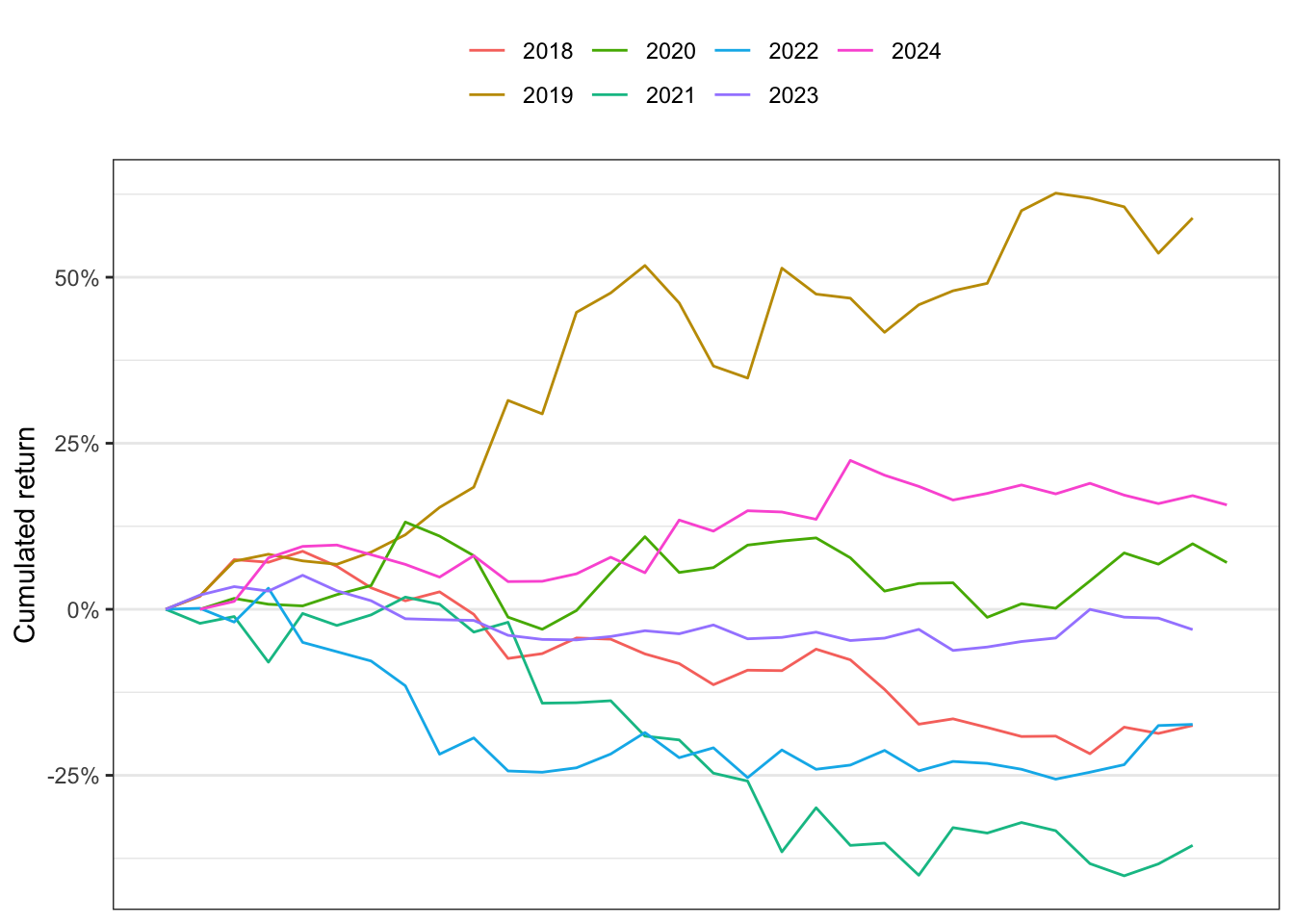

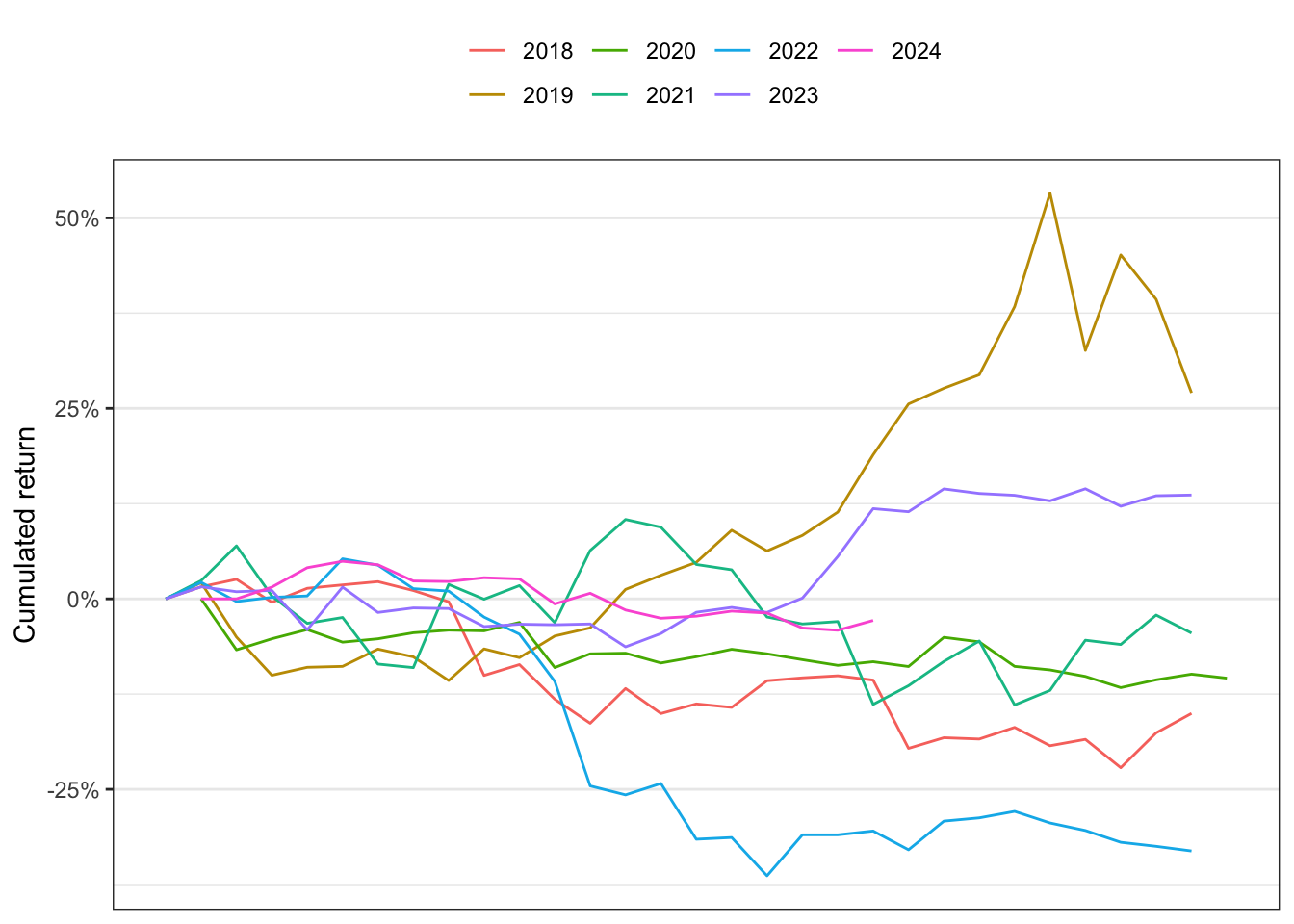

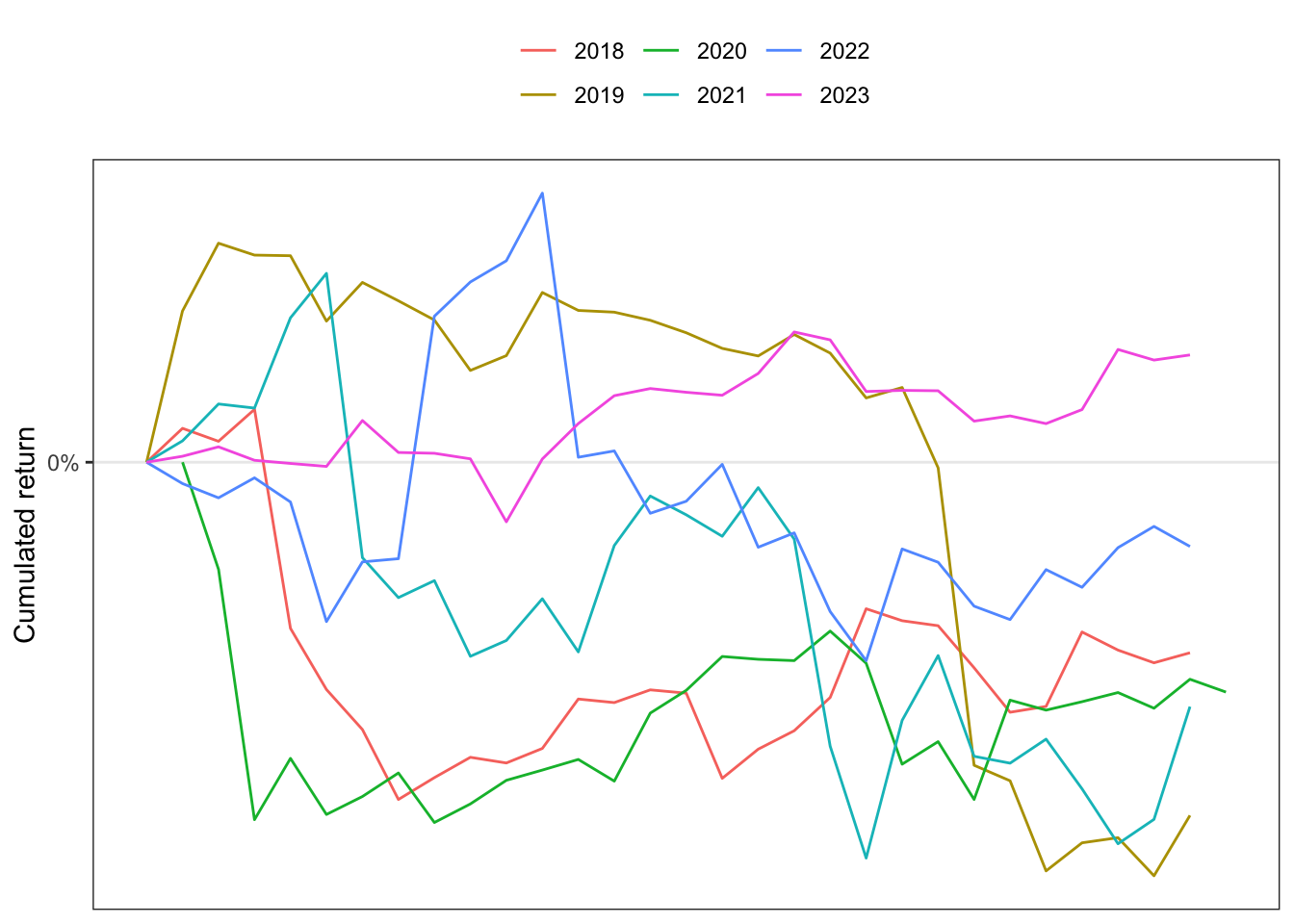

labs(x = NULL)One well-known seasonal effect is the January effect, where BTC returns tend to be above average during the month of January. This phenomenon has been observed over multiple years, suggesting a consistent pattern. Another notable seasonal effect is the December effect, which indicates higher BTC returns during the month of December. Market activity during the holiday season and investor sentiment are factors that may contribute to this effect.

Code

# Compute cumulated return for each year

df_years <- list()

df <- BTCUSDT

df$Year <- lubridate::year(df$date)

df$Year_ <- factor(df$Year, levels = c(min(df$Year):max(df$Year)), ordered = TRUE)

df$n <- solarr::number_of_day(df$date)

for(y in unique(df$Year)){

df_y <- dplyr::filter(df, Year == y)

df_y$Rt <- c(0, diff(log(df_y$close)))

df_y$cum_ret <- cumprod(exp(df_y$Rt))

df_years[[y]] <- df_y

}

df_years <- bind_rows(df_years)

x_breaks <- seq(1, 365, 40)

x_labels <- dplyr::filter(df, Year == 2020)[x_breaks,]$date

x_labels <- str_remove_all(as.Date(x_labels), "2020-")

ggplot(df_years)+

geom_line(aes(n, cum_ret, group = Year_, color = as.character(Year_)))+

theme_bw()+

theme(legend.position = "top")+

scale_x_continuous(breaks = x_breaks, labels = x_labels)+

scale_y_continuous(breaks = seq(0, 4, 0.5), labels = paste0((seq(0, 4, 0.5)-1)*100, "%"))+

labs(color = NULL, y = "Cumulated return", x = NULL)

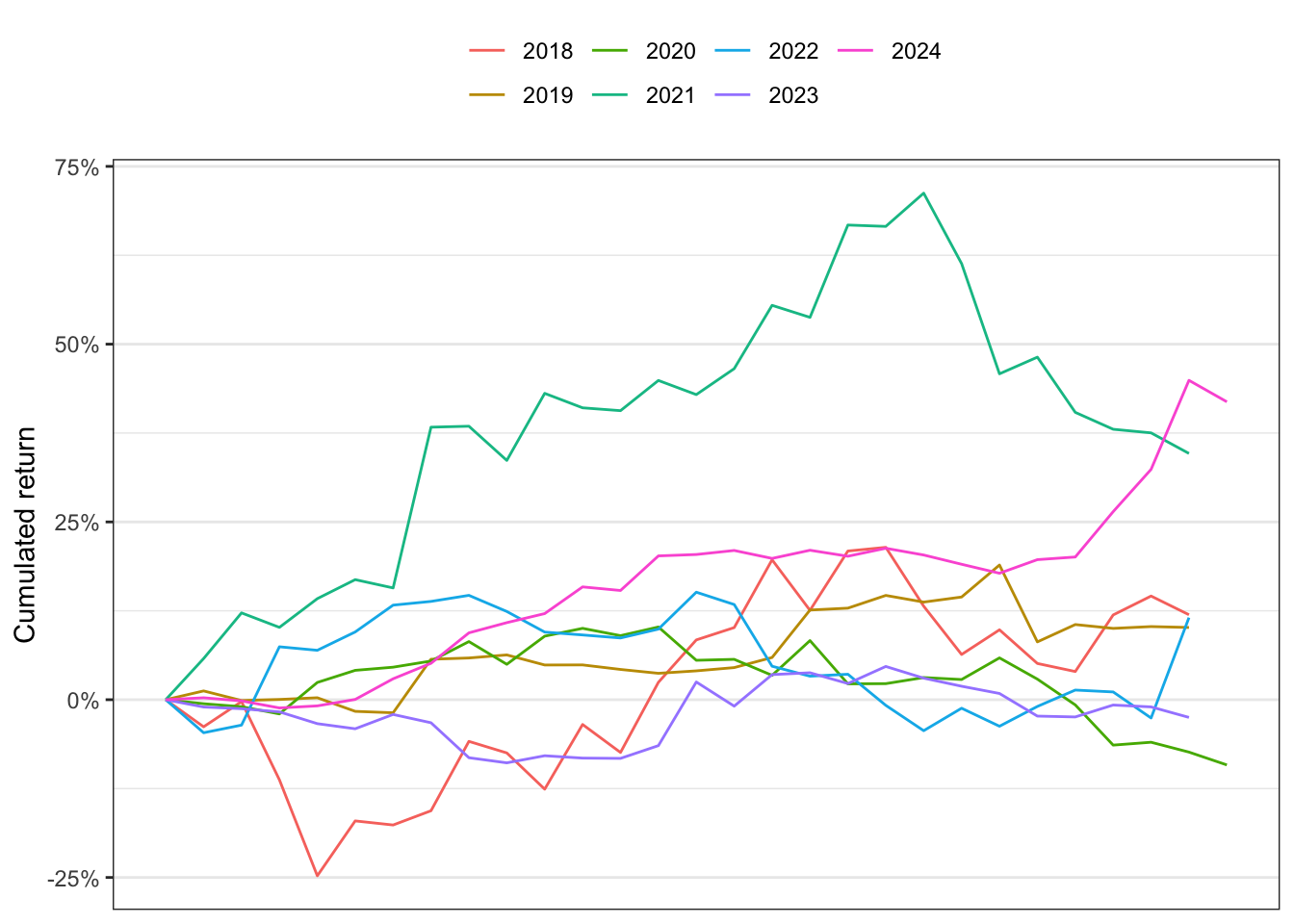

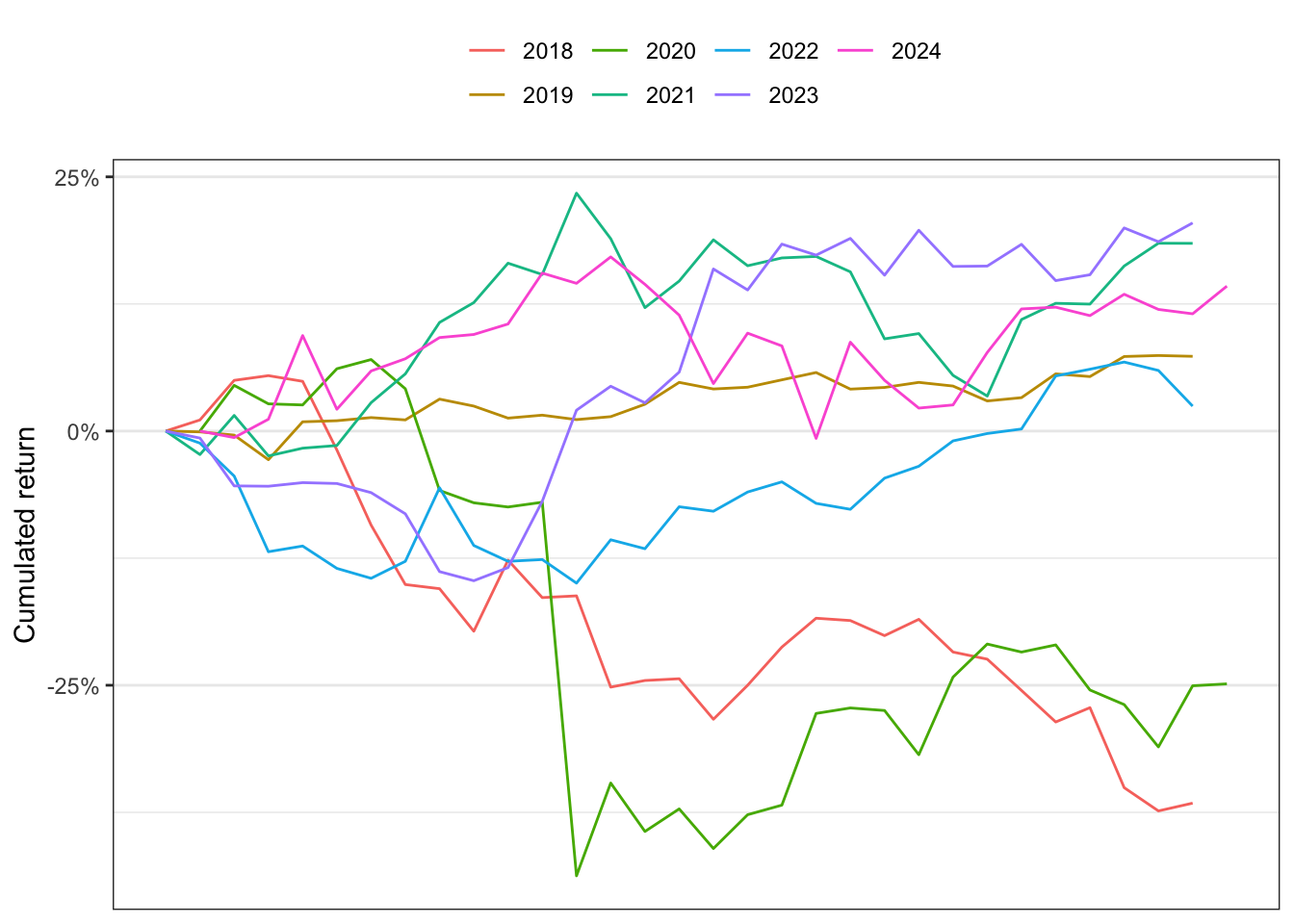

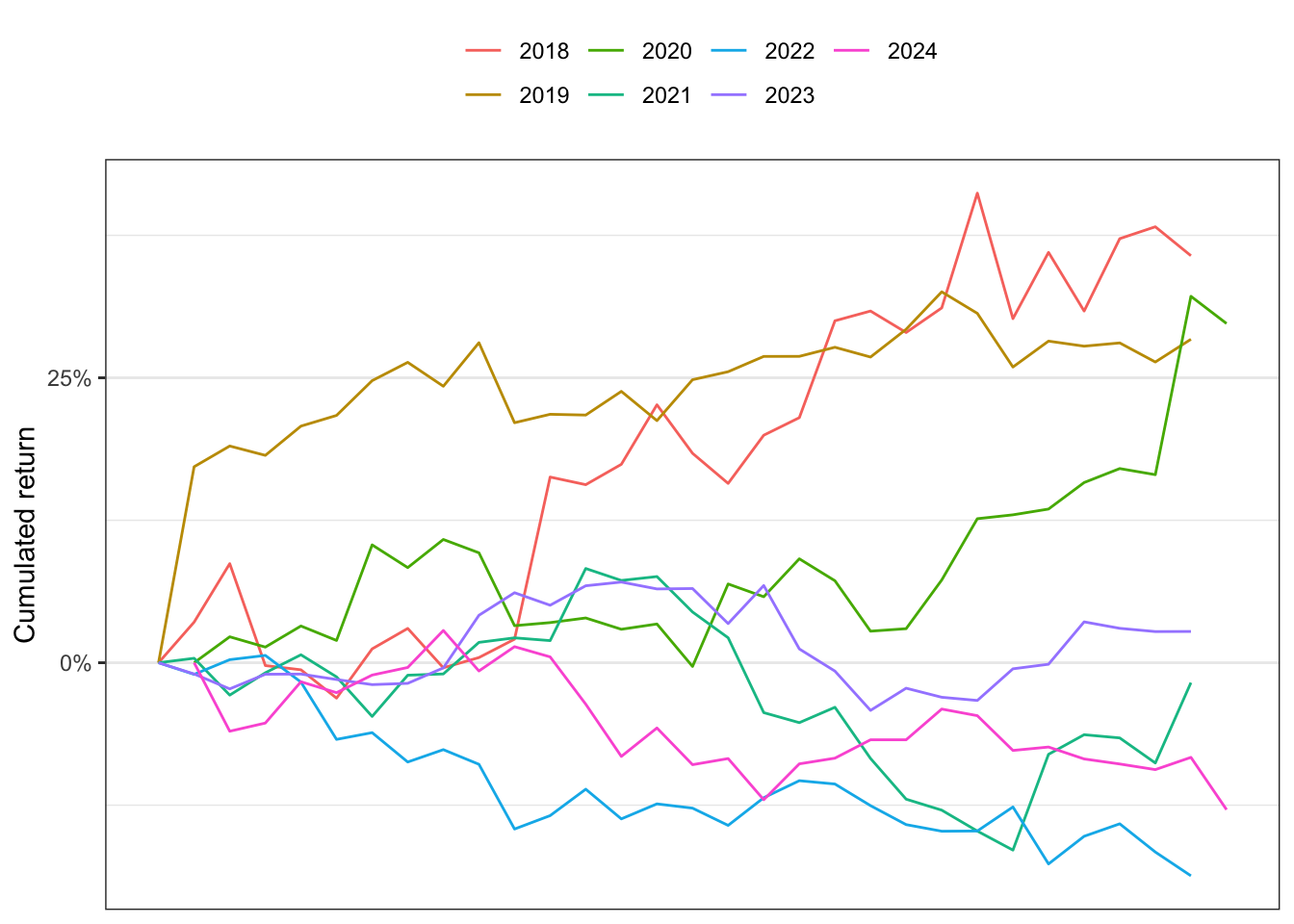

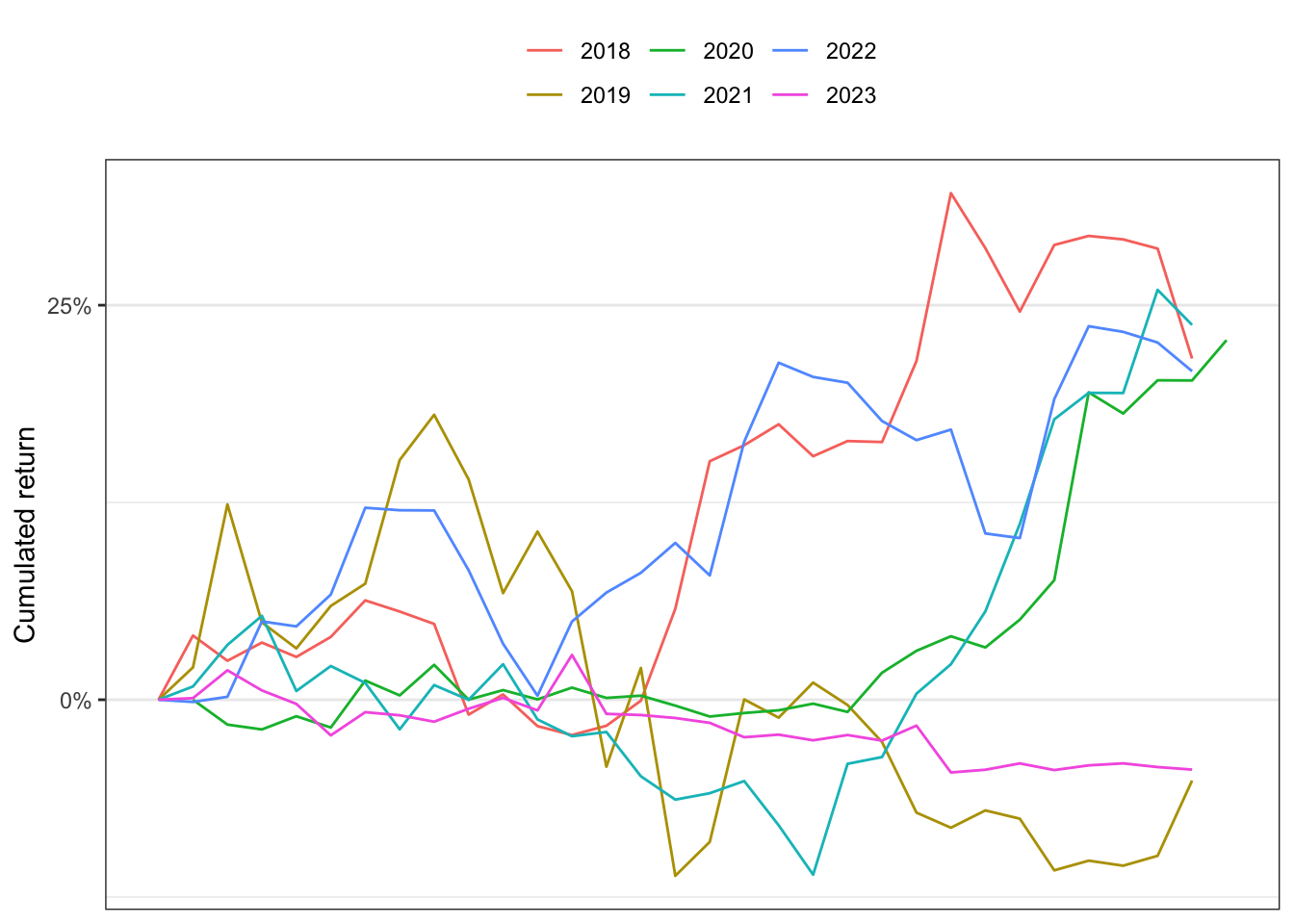

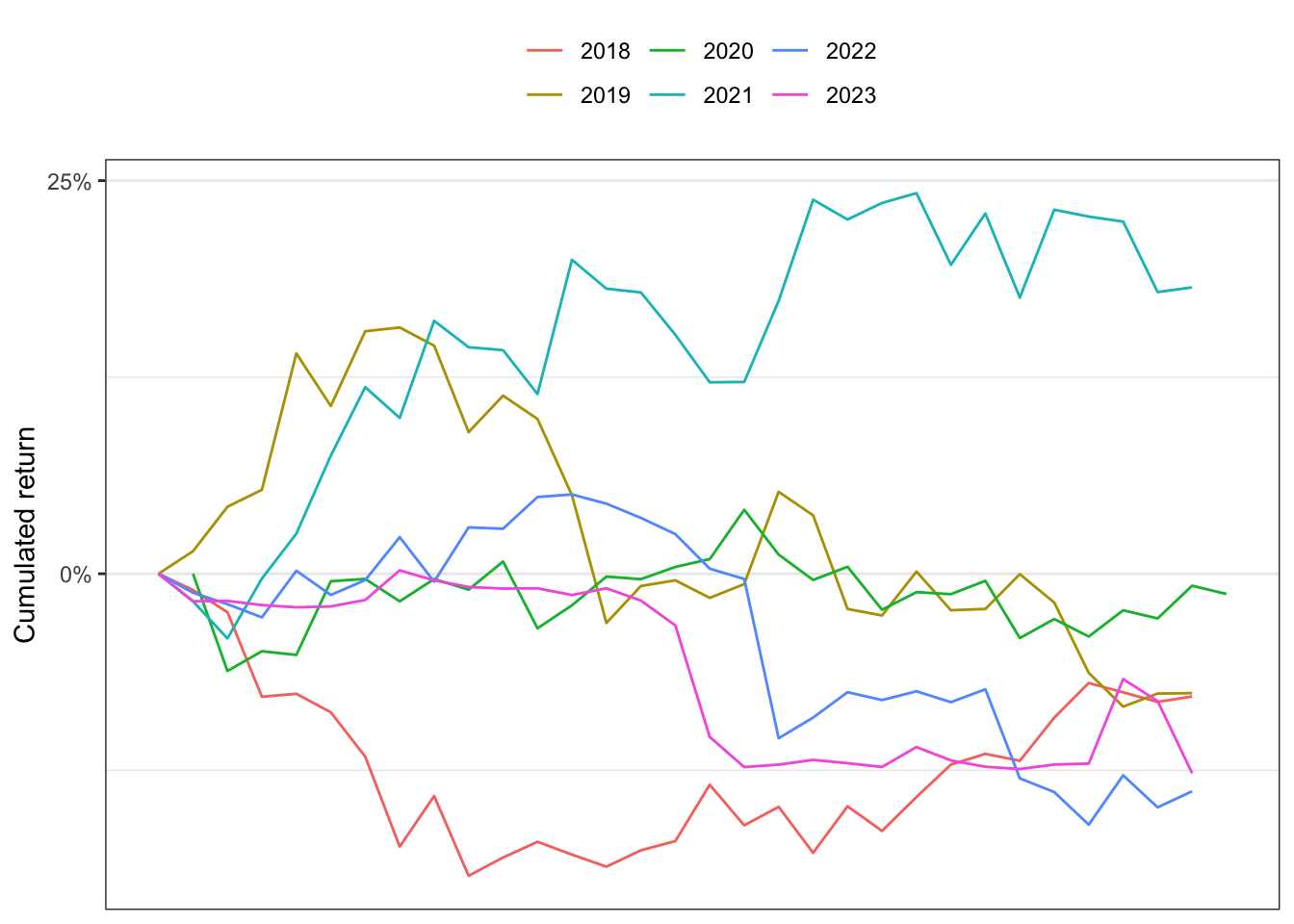

0.1 Monthly seasonality

Code

# Compute cumulated return for each year

df_years <- list()

df <- BTCUSDT

df$Year <- lubridate::year(df$date)

df$Year_ <- factor(df$Year, levels = c(min(df$Year):max(df$Year)), ordered = TRUE)

df$Month <- lubridate::month(df$date)

df$Month_ <- factor(df$Month,

levels = c(1:12),

labels = lubridate::month(1:12, label = TRUE),

ordered = TRUE)

df$Day <- lubridate::day(df$date)

df$n <- solarr::number_of_day(df$date)

k <- 1

for(y in unique(df$Year)){

for(m in unique(df$Month)){

df_y <- filter(df, Year == y & Month == m)

df_y$Rt <- c(0, diff(log(df_y$close)))

df_y$cum_ret <- cumprod(exp(df_y$Rt))

df_years[[k]] <- df_y

k <- k + 1

}

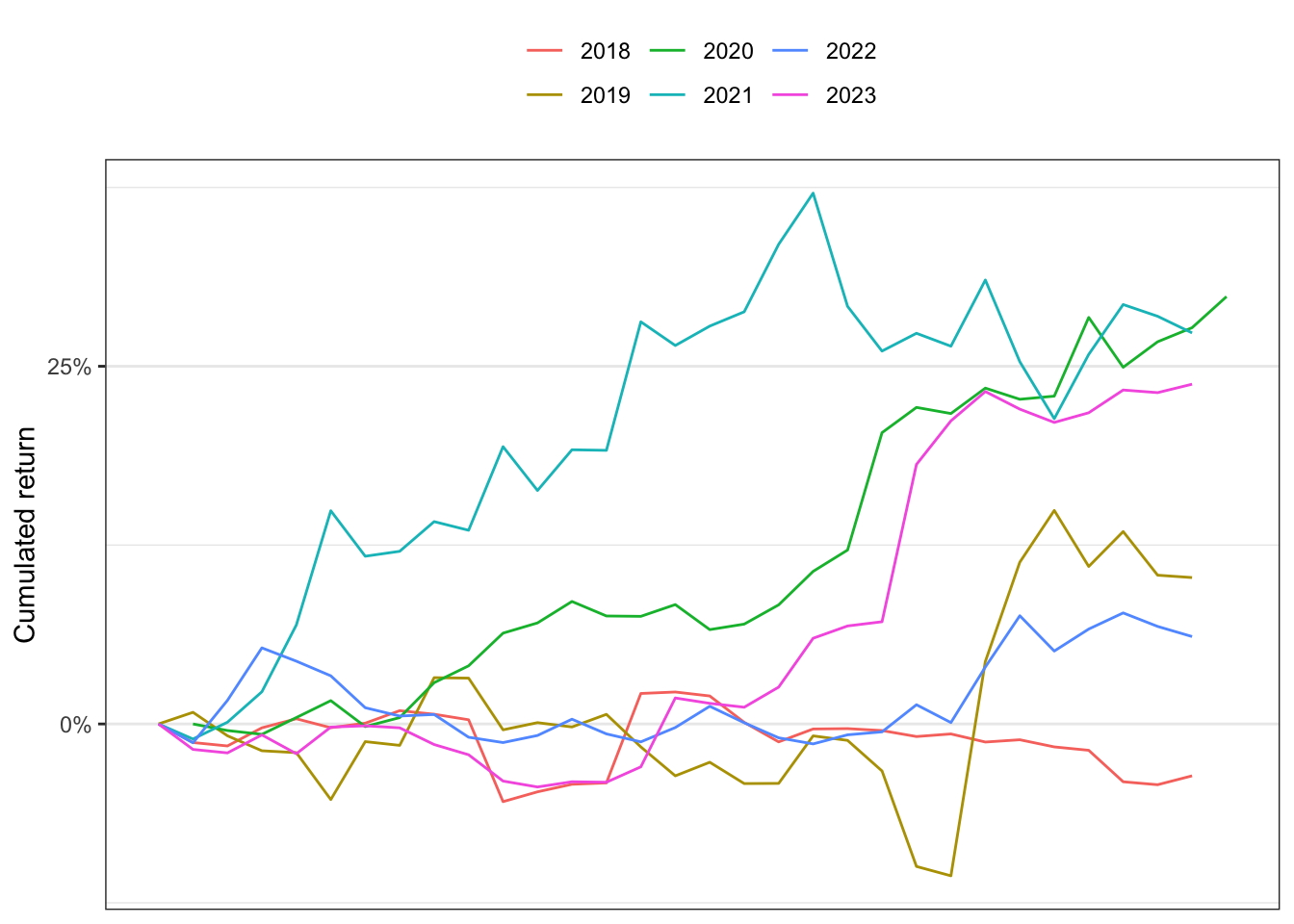

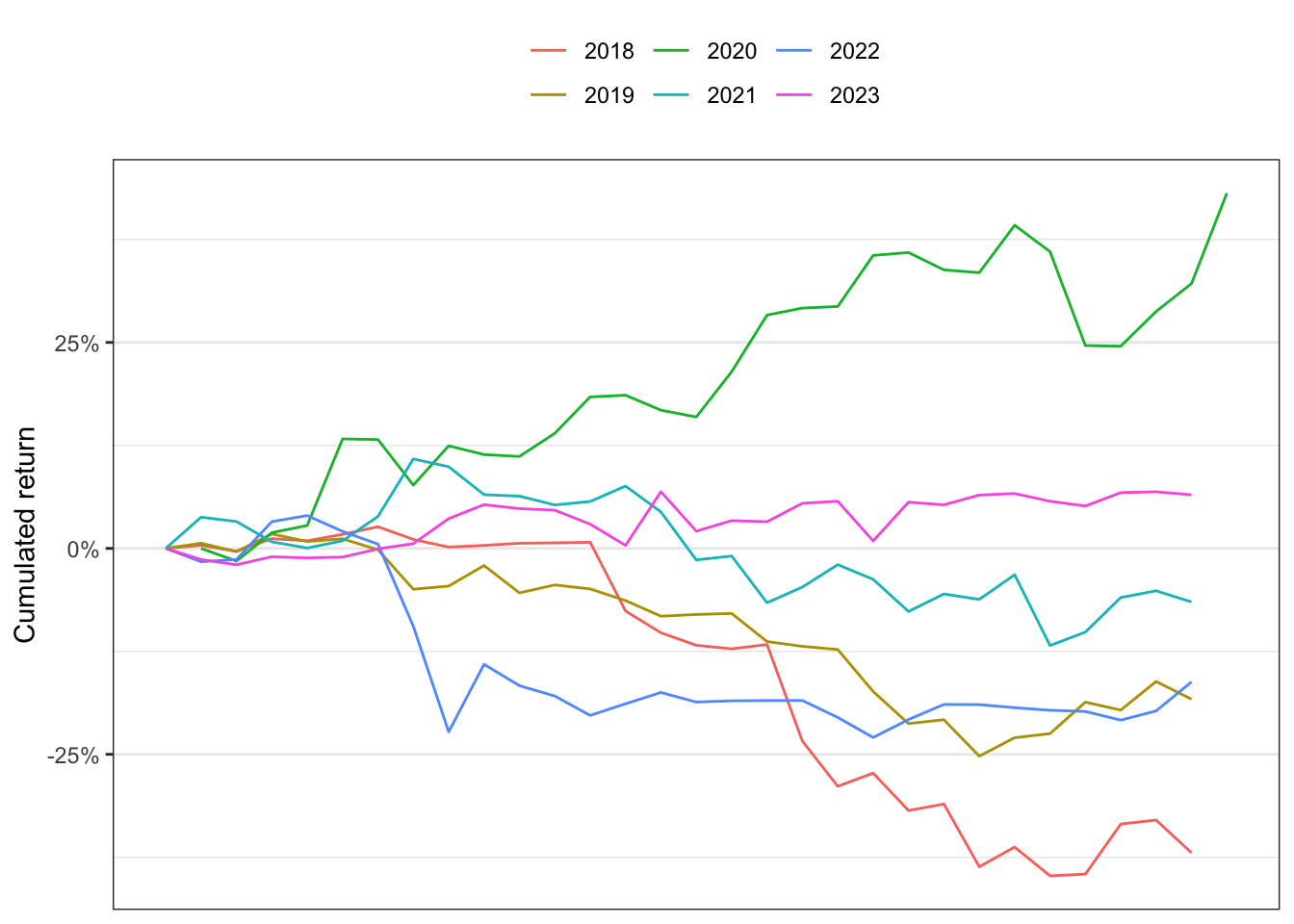

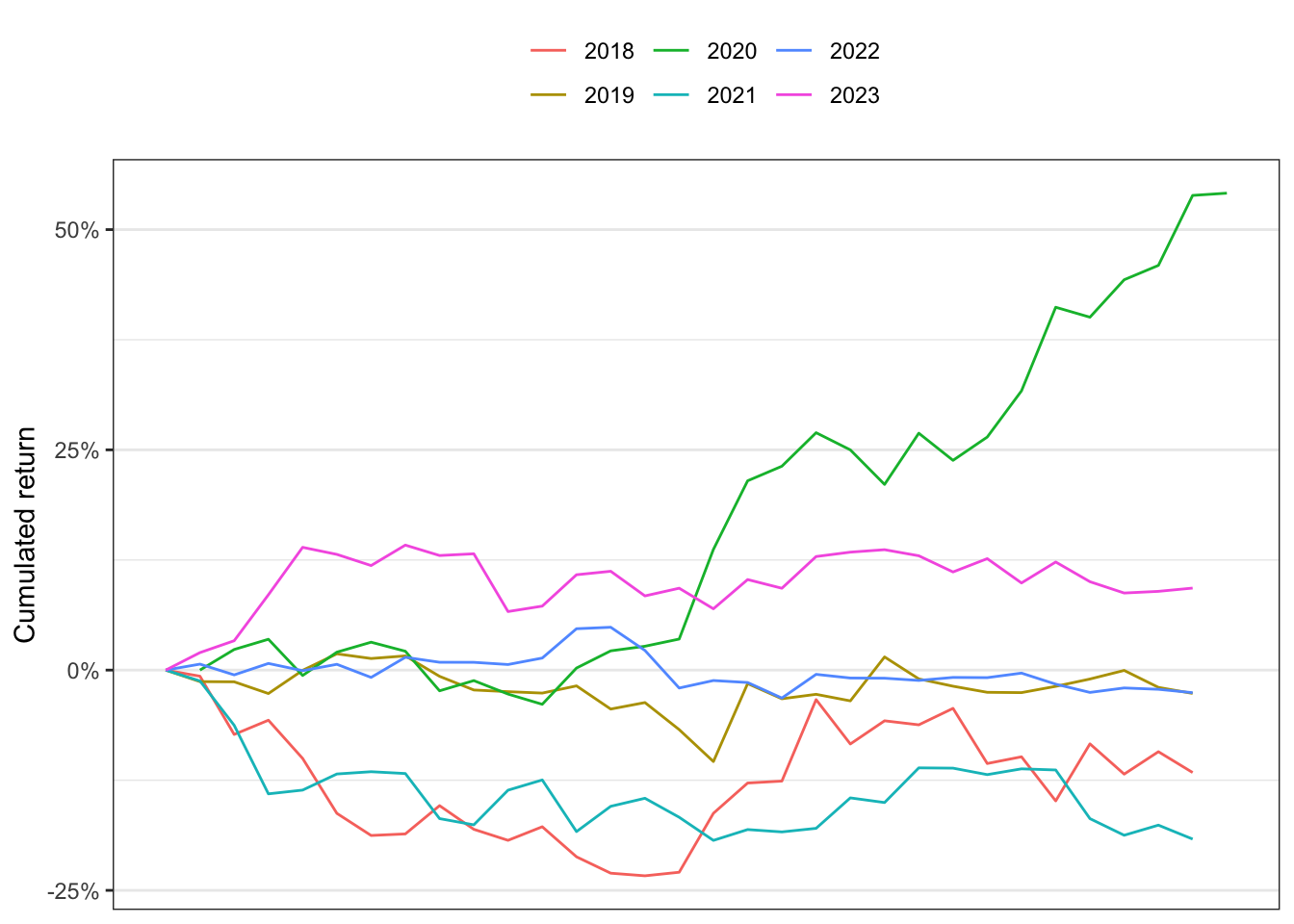

}plot_cumret_month <- function(df_years, m = 1){

df_years <- bind_rows(df_years)

x_breaks <- seq(1, 30, 5)

y_breaks <- seq(0, 2, 0.25)

y_labels <- paste0((seq(0, 2, 0.25)-1)*100, "%")

df_years %>%

filter(Month == m) %>%

ggplot()+

geom_line(aes(n, cum_ret, group = Year_, color = as.character(Year_)))+

theme_bw()+

theme(legend.position = "top")+

scale_x_continuous(breaks = x_breaks)+

scale_y_continuous(breaks = y_breaks, labels = y_labels)+

labs(color = NULL, y = "Cumulated return", x = NULL)

}0.2 Mean return by day and month

The dataset is composed by OHLCV data from binance.com starting from 2018-01-01 up to 2024-06-20.

Code

labels_day <- c("Monday", "Tuesday", "Wednesday", "Thursday", "Friday", "Saturday", "Sunday")

df <- BTCUSDT

# log-price

df$log_close <- log(df$close)

# log-return

df$ret <- c(0, diff(df$log_close))

df <- df %>%

mutate(

pos_ret = ifelse(ret >= 0, 1, 0),

Month = lubridate::month(date, label = TRUE),

weekday = weekdays(df$date),

weekday = factor(weekday, ordered = TRUE, levels = labels_day),

Monday = ifelse(weekday == labels_day[1], 1, 0),

Tuesday = ifelse(weekday == labels_day[2], 1, 0),

Wednesday = ifelse(weekday == labels_day[3], 1, 0),

Thursday = ifelse(weekday == labels_day[4], 1, 0),

Friday = ifelse(weekday == labels_day[5], 1, 0),

Saturday = ifelse(weekday == labels_day[6], 1, 0),

Sunday = ifelse(weekday == labels_day[7], 1, 0),

weekend = ifelse(weekday %in% labels_day[6:7], 1, 0),

workday = ifelse(!(weekday %in% labels_day[6:7]), 1, 0))

head(df, n = 5) %>%

bind_rows() %>%

DT::datatable(rownames = FALSE,

options = list(

dom = 't',

pageLength = 12,

searching = FALSE,

paging = FALSE,

initComplete = DT::JS(

"function(settings, json) {",

"$(this.api().table().header()).css({'background-color':

'#000', 'color': '#FFC525'});", "}"))) %>%

DT::formatStyle(c(1:12),target='row', backgroundColor = "#F3F7F9")%>%

DT::formatDate(c("date", "date_close"))0.3 Mean returns

Code

df_pos_ret <- df %>%

group_by(Month, weekday) %>%

summarise(p = mean(pos_ret)) %>%

spread(weekday, p)

# create 19 breaks and 20 rgb color values ranging from white to red

brks <- quantile(df_pos_ret[,-1], probs = seq(.01, .95, .01), na.rm = TRUE)

clrs <- colorRampPalette(c("red", "white", "green"))(length(brks) + 1)

df_pos_ret[,1] <- lubridate::month(1:12, label = TRUE, abbr = FALSE)

datatable(df_pos_ret, rownames = FALSE,

options = list(pageLength = 12, searching = FALSE, paging = FALSE)) %>%

formatPercentage(columns = label_days, digits = 2) %>%

formatStyle(label_days, backgroundColor = styleInterval(brks, clrs)) 1 Statistical evidence of a weekend effect?

Here weekend is Saturday or Sunday and

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 0.50148 | 0.01216 | 41.23956 | 0.00000 |

| weekend | 0.03858 | 0.02277 | 1.69438 | 0.09032 |

| r.squared | adj.r.squared | sigma | statistic | p.value | df | df.residual | nobs |

|---|---|---|---|---|---|---|---|

| 0.00121 | 0.00079 | 0.49975 | 2.87093 | 0.09032 | 1 | 2361 | 2363 |

Citation

@online{sartini2024,

author = {Sartini, Beniamino},

title = {Seasonality of {Bitcoin} Returns?},

date = {2024-06-22},

url = {https://cryptoverser.org/articles/bitcoin-seasonality/bitcoin-seasonality.html},

langid = {en}

}