| Quantity | Price |

|---|---|

1 Order Book

An order book is a set of quantities and prices for a given time

These quantities are usually ordered in such a way that:

1.1 Mid-quote

The trade price and mid-quote series are commonly used in the literature. The micro-price, more familiar to practitioners, linearly weighs the bid and ask prices by the volume on the opposite side of the book and can thus be interpreted as the market clearing price when demand and supply curves are linear in price.

Show the code

# import depth data from binance

library(binancer)

library(dplyr)

depth <- binance_depth(api = "spot", pair = "BTCUSDT", quiet = TRUE)

# best ask and bid

bask <- tail(dplyr::filter(depth, side == "ASK"), n = 1) # best ask

bbid <- head(dplyr::filter(depth, side == "BID"), n = 1) # best bid

dplyr::bind_rows(bask, bbid) %>%

knitr::kable() %>%

kableExtra::kable_classic_2()| last_update_id | date | market | pair | side | price | quantity |

|---|---|---|---|---|---|---|

| 47329760756 | 2024-05-24 14:33:31 | spot | BTCUSDT | ASK | 67430.01 | 6.51457 |

| 47329760756 | 2024-05-24 14:33:31 | spot | BTCUSDT | BID | 67430.00 | 1.51181 |

The mid-quote is computed as mean price among the best BID and ASK prices:

1.2 BID-ASK Spread

The bid-ask spread is the mean distance between the best BID and ASK prices:

1.3 Micro Price

The micro-price

Show the code

| last_update_id | date | market | pair | mid_price | spread | micro_price |

|---|---|---|---|---|---|---|

| 47329760756 | 2024-05-24 14:33:31 | spot | BTCUSDT | 67430.01 | 0.005 | 67430.01 |

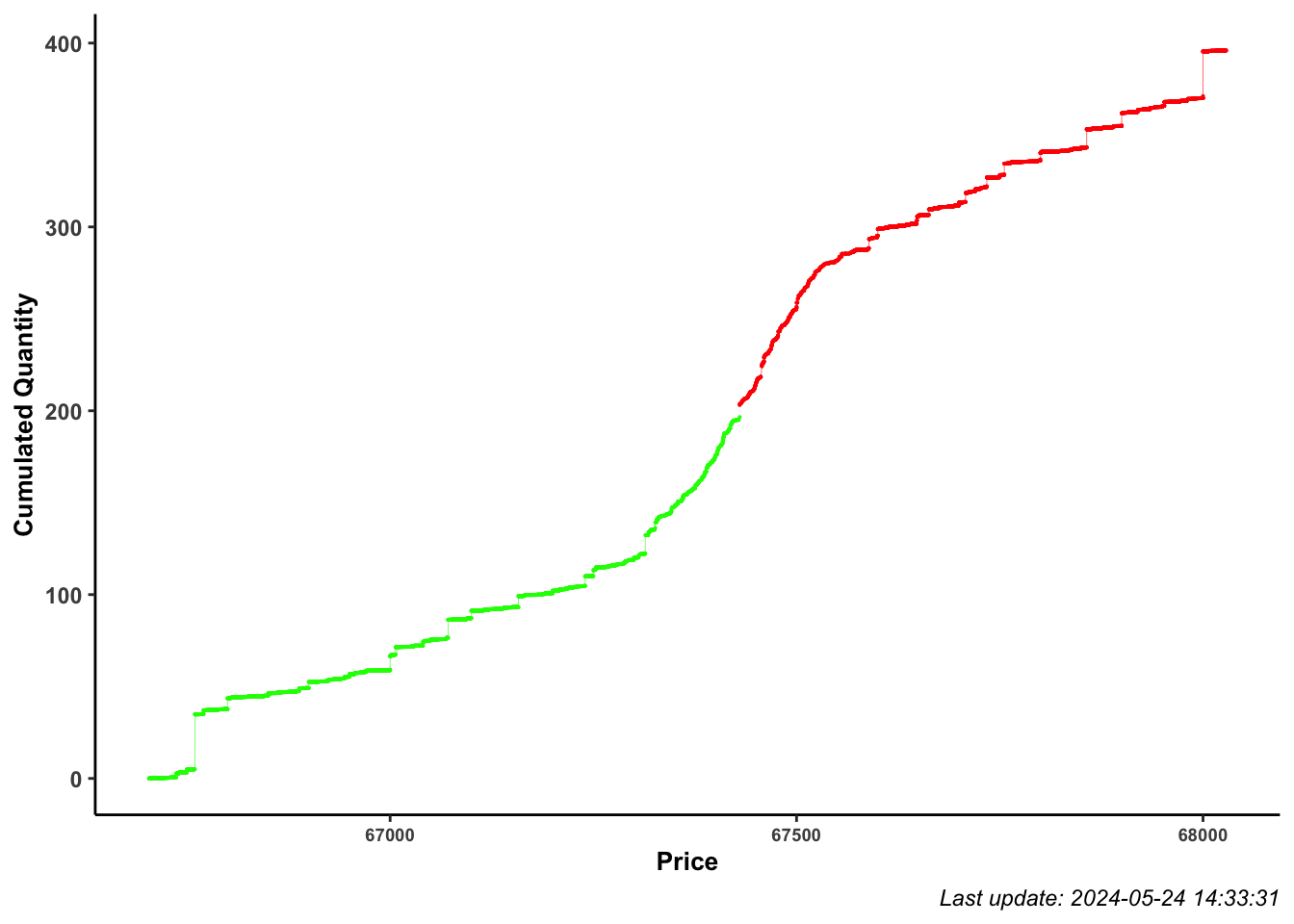

2 Liquidity curve

Consider

Show the code

library(ggplot2)

# order by price (descending)

plot_data <- dplyr::arrange(depth, price)

# Compute cumulated quantity

plot_data$cum_quantity <- cumsum(plot_data$quantity)

ggplot()+

geom_line(data = plot_data, aes(price, cum_quantity, color = side), size = 0.1)+

geom_point(data = plot_data, aes(price, cum_quantity, color = side), size = 0.05)+

scale_color_manual(values = c(ASK = "red", BID = "green"))+

labs(x = "Price",

y = "Cumulated Quantity",

color = "Side",

caption = paste0("Last update: ", depth$date[1]))+

theme(axis.title = element_text(face = "bold"),

plot.title = element_text(face = "bold"),

axis.line = element_line(),

axis.text.x = element_text(angle = 0, face = "bold", size = 7),

axis.text.y = element_text(face = "bold"),

axis.title.x = element_text(face = "bold",size = 10),

axis.title.y = element_text(face = "bold", size = 10),

plot.subtitle = element_text(face = "italic"),

plot.caption = element_text(face = "italic"),

panel.grid.minor.x = element_blank(),

panel.grid.minor.y = element_blank(),

panel.grid.major.x = element_blank(),

panel.grid.major.y = element_blank(),

panel.border = element_blank(),

strip.background = element_blank(),

panel.background = element_blank(),

strip.text = element_text(angle = 0, face = "bold", size = 7),

legend.title = element_text(face = "bold", size = 11),

legend.text = element_text(face = "italic", size = 10),

legend.box.background = element_rect(),

legend.position = "none")

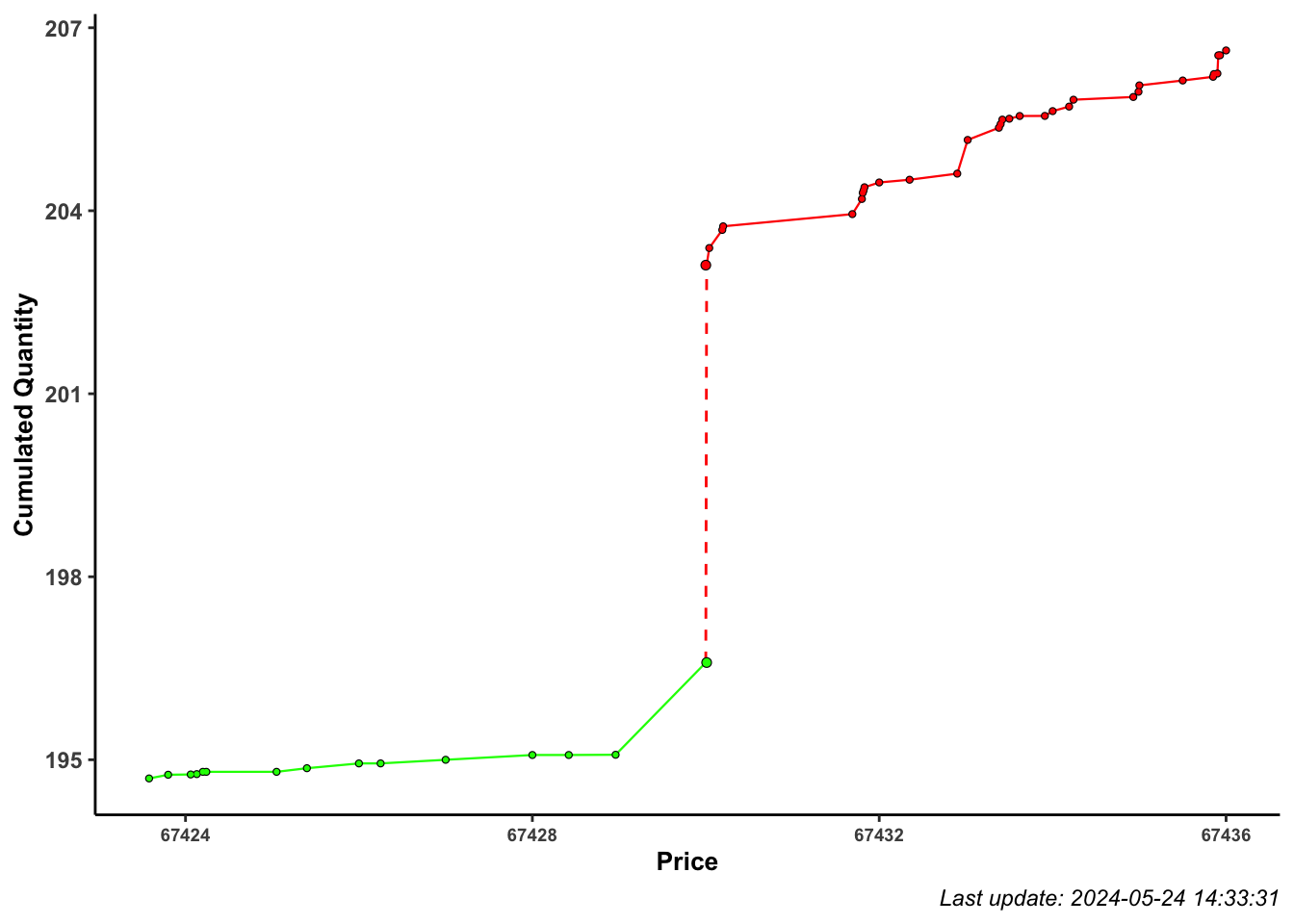

Show the code

library(ggplot2)

depth_level <- 0.0001 # i.e. 0.01 %

# Arrange the prices in descending order

plot_data <- dplyr::arrange(depth, price)

# Compute cumulated quantity

plot_data$cum_quantity <- cumsum(plot_data$quantity)

# Index best ASK and BID

idx_best_ASK <- which(plot_data$side == "ASK")[1]

idx_best_BID <- idx_best_ASK - 1

# Microprice coordinates

x <- bbid$price

y <- plot_data$cum_quantity[idx_best_BID]

xend <- bask$price

yend <- plot_data$cum_quantity[idx_best_ASK]

mp <- c(x, xend, y, yend)

# Zoom dataset

plot_data <- filter(plot_data, price >= bbid$micro_price*(1 - depth_level) & price <= bbid$micro_price*(1 + depth_level))

ggplot()+

geom_line(data = plot_data, aes(price, cum_quantity, color = side), size = 0.4)+

geom_point(data = plot_data, aes(price, cum_quantity), color = "black", size = 0.8)+

geom_point(data = plot_data, aes(price, cum_quantity, color = side), size = 0.4)+

geom_segment(aes(x = mp[1], xend = mp[2], y = mp[3], yend = mp[4]), linetype="dashed", color = "red")+

geom_point(aes(x = mp[1], y = mp[4]), size=1.3, color = "black")+

geom_point(aes(x = mp[1], y = mp[4]), size=0.9, color = "red")+

geom_point(aes(x = mp[2], y = mp[3]), size=1.3, color = "black")+

geom_point(aes(x = mp[2], y = mp[3]), size=0.9, color = "green")+

scale_color_manual(values = c(ASK = "red", BID = "green"))+

labs(x = "Price",

y = "Cumulated Quantity",

color = "Side",

caption = paste0("Last update: ", depth$date[1]))+

theme(axis.title = element_text(face = "bold"),

plot.title = element_text(face = "bold"),

axis.line = element_line(),

axis.text.x = element_text(angle = 0, face = "bold", size = 7),

axis.text.y = element_text(face = "bold"),

axis.title.x = element_text(face = "bold",size = 10),

axis.title.y = element_text(face = "bold", size = 10),

plot.subtitle = element_text(face = "italic"),

plot.caption = element_text(face = "italic"),

panel.grid.minor.x = element_blank(),

panel.grid.minor.y = element_blank(),

panel.grid.major.x = element_blank(),

panel.grid.major.y = element_blank(),

panel.border = element_blank(),

strip.background = element_blank(),

panel.background = element_blank(),

strip.text = element_text(angle = 0, face = "bold", size = 7),

legend.title = element_text(face = "bold", size = 11),

legend.text = element_text(face = "italic", size = 10),

legend.box.background = element_rect(),

legend.position = "none")

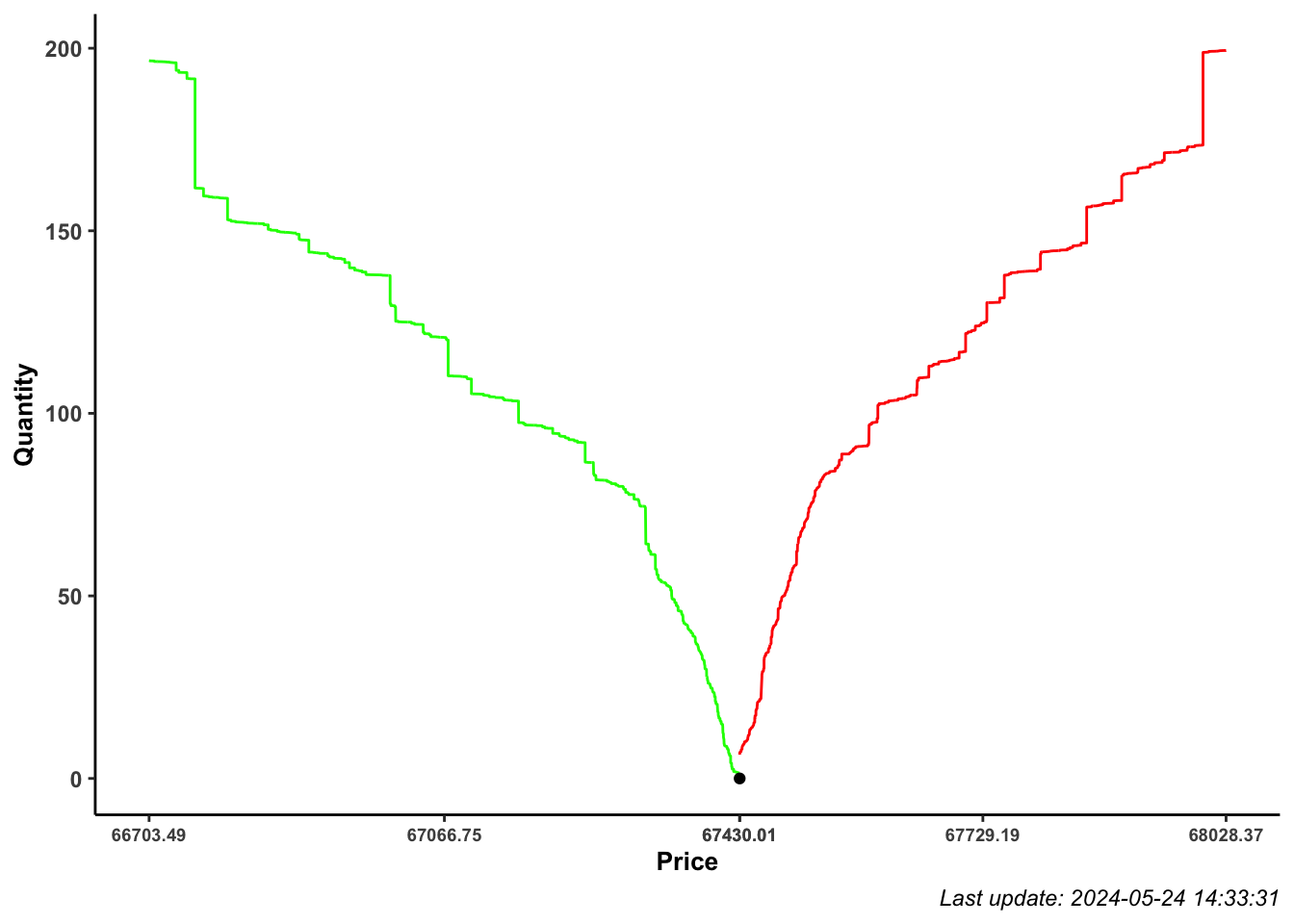

2.1 Depth curve

Show the code

# ASK orders

ask <- dplyr::filter(depth, side == "ASK")

# Arrange by price (descending)

ask <- dplyr::arrange(ask, price)

# Compute cumulated quantity

ask$cum_quantity <- cumsum(ask$quantity)

# BID orders

bid <- dplyr::filter(depth, side == "BID")

# Arrange by price (ascending)

bid <- dplyr::arrange(bid, dplyr::desc(price))

# Compute cumulated quantity

bid$cum_quantity <- cumsum(bid$quantity)

x_breaks <- c(seq(min(bid$price), bbid$micro_price, length.out = 3), seq(bbid$micro_price, max(ask$price), length.out = 3))

ggplot()+

geom_line(data = dplyr::bind_rows(ask, bid), aes(price, cum_quantity, color = side))+

geom_point(aes(bbid$micro_price, 0), color = "black")+

scale_color_manual(values = c(ASK = "red", BID = "green"))+

scale_x_continuous(breaks = x_breaks, labels = round(x_breaks, 2))+

labs(x = "Price",

y = "Quantity",

color = "Side",

caption = paste0("Last update: ", depth$date[1]))+

theme(axis.title = element_text(face = "bold"),

plot.title = element_text(face = "bold"),

axis.line = element_line(),

axis.text.x = element_text(angle = 0, face = "bold", size = 7),

axis.text.y = element_text(face = "bold"),

axis.title.x = element_text(face = "bold",size = 10),

axis.title.y = element_text(face = "bold", size = 10),

plot.subtitle = element_text(face = "italic"),

plot.caption = element_text(face = "italic"),

panel.grid.minor.x = element_blank(),

panel.grid.minor.y = element_blank(),

panel.grid.major.x = element_blank(),

panel.grid.major.y = element_blank(),

panel.border = element_blank(),

strip.background = element_blank(),

panel.background = element_blank(),

strip.text = element_text(angle = 0, face = "bold", size = 7),

legend.title = element_text(face = "bold", size = 11),

legend.text = element_text(face = "italic", size = 10),

legend.box.background = element_rect(),

legend.position = "none")

References

Citation

@online{sartini2024,

author = {Sartini, Beniamino},

title = {Microprice and {Liquidity} {Curve}},

date = {2024-01-17},

url = {https://cryptoverser.org/articles/signals-microprice/signals-microprice.html},

langid = {en}

}